The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

Tag: Mike Fratantoni

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

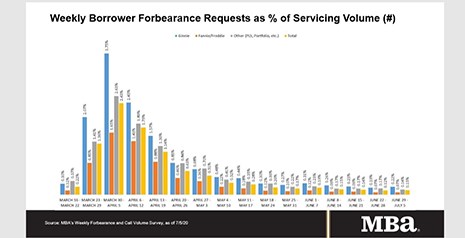

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

MISMO Launches Initiative to Facilitate Servicing Transfers

MISMO®, the mortgage industry’s standards organization, is seeking industry participants to collaborate on a new initiative to facilitate servicing transfers.

Housing Starts Post Healthy June Gain

July has been a good month for the housing industry thus far; HUD and the Census Bureau kept the momentum going Friday with a positive report on housing starts.

MISMO Launches Initiative to Facilitate Servicing Transfers

MISMO®, the mortgage industry’s standards organization, is seeking industry participants to collaborate on a new initiative to facilitate servicing transfers.

MISMO Launches Initiative to Facilitate Servicing Transfers

MISMO®, the mortgage industry’s standards organization, is seeking industry participants to collaborate on a new initiative to facilitate servicing transfers.

MBA: Share of Loans in Forbearance Falls 4th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 21 basis points to 8.18% of servicers’ portfolio volume for the week of July 5, from 8.39% the week before. MBA now estimates 4.1 million homeowners are in forbearance plans, down from 4.2 million the previous week.

MBA: Share of Loans in Forbearance Falls 4th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 21 basis points to 8.18% of servicers’ portfolio volume for the week of July 5, from 8.39% the week before. MBA now estimates 4.1 million homeowners are in forbearance plans, down from 4.2 million the previous week.

MISMO Certifies First Two Remote Online Notary Products

MISMO®, the mortgage industry standards organization, today announced eNotaryLog and Notarize are the first two companies to complete MISMO’s new Remote Online Notarization certification program. RON certification provides assurance that products fulfill the requirements of the MISMO Remote Online Notary Standards.