MBA: Share of Mortgage Loans in Forbearance Dips to 8.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 8.47%of servicers’ portfolio volume as of June 21, a slight decrease from 8.48% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

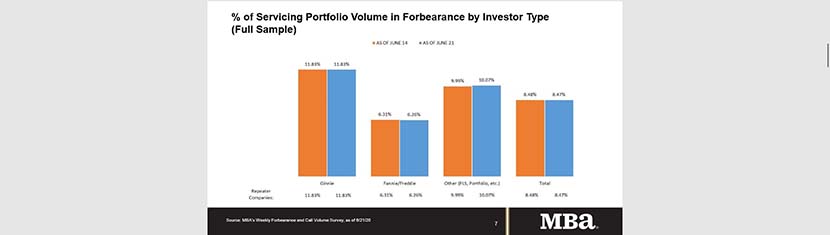

MBA reported the share of Fannie Mae and Freddie Mac loans in forbearance dropped for the third week in a row to 6.26% – a 5-basis-point improvement. The forbearance share for portfolio loans and private-label securities increased by 8 basis points to 10.07%. Ginnie Mae loans in forbearance remained unchanged at 11.83%. The percentage for depository servicers dropped for the second week in a row to 9.09%, while the percentage of loans in forbearance for independent mortgage bank servicers increased to 8.42%.

“The overall share of loans in forbearance declined for the second week in a row, led by the third straight drop in GSE loans,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “Many borrowers initially received a three-month forbearance term, and as of June 21, 17 percent of loans in forbearance have now been extended, with the largest share of those being Ginnie Mae loans.”

Fratantoni noted the level of forbearance requests remains “quite low” as of mid-June. “The rebound in the housing market is likely one of the factors that is providing confidence to both potential homebuyers and existing homeowners during these troubled times,” he said.

Key findings of the MBA Forbearance and Call Volume Survey – June 15-21:

- Total loans in forbearance decreased by 1 basis point relative to the prior week: from 8.48% to 8.47%.

- By investor type, the share of Ginnie Mae loans in forbearance remained flat relative to the prior three weeks at 11.83%.

- The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior week: from 6.31% to 6.26%.

- The share of other loans (e.g., portfolio and PLS loans) in forbearance increased relative to the prior week: from 9.99% to 10.07%.

- Forbearance requests as a percent of servicing portfolio volume (#) decreased across all investor types: from 0.15% to 0.14%.

- Weekly servicer call center volume:

- As a percent of servicing portfolio volume (#), calls increased from 7.7% to 7.8%.

- Average speed to answer increased relative to the prior week from 1.5 minutes to 1.8 minutes.

- Abandonment rates increased from 4.6% to 5.5%.

- Average call length decreased from 7.1 minutes to 7.0 minutes.

- Loans in forbearance as a share of servicing portfolio volume (#) as of June 21, 2020:

- Total: 8.47% (previous week: 8.48%)

- IMBs: 8.42% (previous week: 8.40%)

- Depositories: 9.09% (previous week: 9.15%)

MBA’s latest Forbearance and Call Volume Survey covers the period from June 15-21 and represents 76% of the first-mortgage servicing market (38.2 million loans).

Note: Due to the Independence Day weekend, MBA will release results of its next Forbearance and Call Volume Survey – covering June 22-28 – on Tuesday, July 7, at 4:00 p.m. ET.