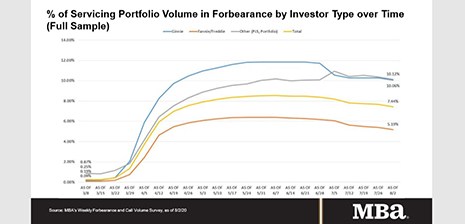

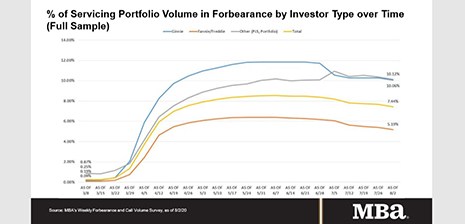

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

Tag: Mike Fratantoni

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

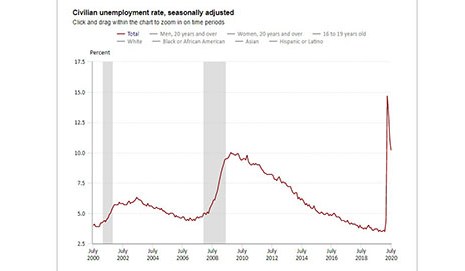

July Jobs Up Nearly 2 Million; Unemployment Rate Drops

The Bureau of Labor Statistics reported nonfarm payroll employment increased by 1.8 million during July, pushing the unemployment rate down to 10.2 percent.

Mortgage Applications Decrease in MBA Weekly Survey

Mortgage applications decreased 5.1 percent from one week earlier, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending July 31.

MBA: Share of Mortgage Loans in Forbearance Decreases for Seventh Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans in forbearance decreased 7 basis points to 7.67% of servicers’ portfolio volume as of July 26 from 7.74% in the prior week.

MBA: Share of Mortgage Loans in Forbearance Decreases for Seventh Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans in forbearance decreased 7 basis points to 7.67% of servicers’ portfolio volume as of July 26 from 7.74% in the prior week.

MBA: Share of Mortgage Loans in Forbearance Decreases for Seventh Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans in forbearance decreased 7 basis points to 7.67% of servicers’ portfolio volume as of July 26 from 7.74% in the prior week.

Momentum Builds as 2nd FHLB Accepts eNotes

Earlier this month, the Federal Home Loan Bank of Des Moines became the first of the 11-member FHLB system to announce it would accept residential mortgage electronic promissory notes—eNotes—as collateral. Now, a second FHLB has jumped on the eNotes bandwagon.

Fed: No Change in Policy Anytime Soon

The Federal Open Market Committee yesterday said ongoing concerns about the coronavirus and the resulting economic stall means it will hold fast on its current policies.