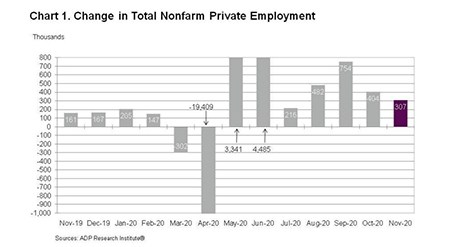

Ahead of this morning’s weekly Initial Claims report by the Labor Department and Friday’s Employment report by the Bureau of Labor Statistics, ADP, Roseland, N.J., said private-sector employment increased by 307,000 jobs from October to November.

Tag: Mike Fratantoni

MBA: Share of Mortgage Loans in Forbearance Increases to 5.54%

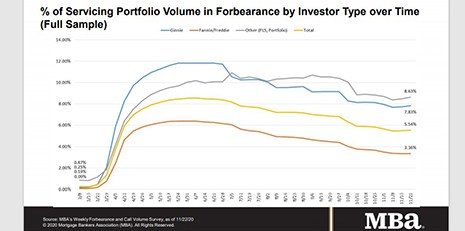

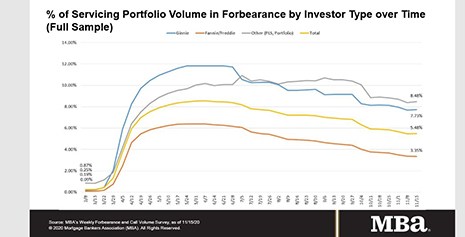

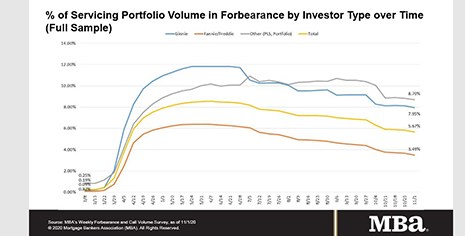

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.54% of servicers’ portfolio volume as of November 22, 2020 from 5.48% the prior week. MBA estimates 2.8 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.54% of servicers’ portfolio volume as of November 22, 2020 from 5.48% the prior week. MBA estimates 2.8 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Edges Up to 5.48%

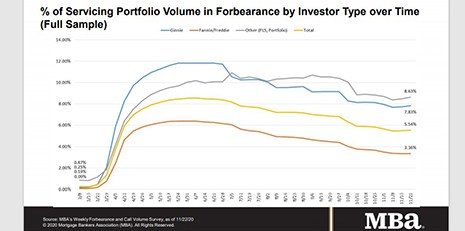

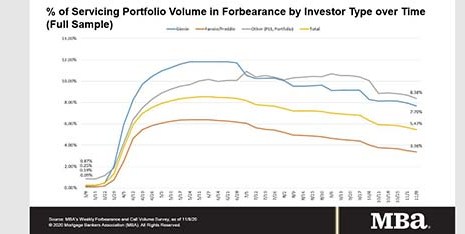

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.48% of mortgage servicers’ portfolio volume as of November 15, from 5.47% the week before. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Edges Up to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.48% of mortgage servicers’ portfolio volume as of November 15, from 5.47% the week before. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Falls to 5.47%

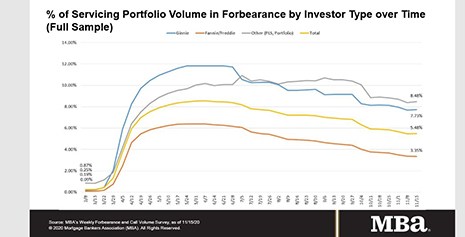

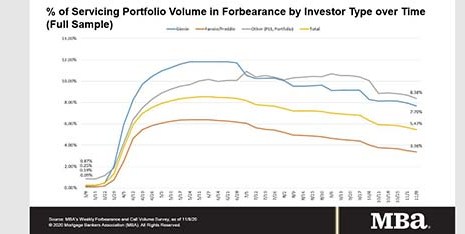

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased for the 11th week in a row, to 5.47% of servicers’ portfolio volume as of Nov. 8 from 5.67% the prior week – a 20-basis-point improvement. MBA now estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Falls to 5.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased for the 11th week in a row, to 5.47% of servicers’ portfolio volume as of Nov. 8 from 5.67% the prior week – a 20-basis-point improvement. MBA now estimates 2.7 million homeowners are in forbearance plans.

MISMO Appoints Seth Appleton as President

MISMO® announced today it appointed Seth Appleton as its new president. Appleton currently serves as Assistant Secretary of Policy Development and Research with HUD and as Principal Executive Vice President of Ginnie Mae.

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.67%

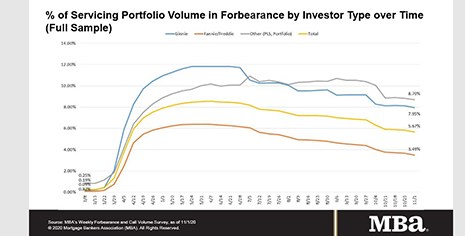

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.67%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.