Join us for an exclusive deep dive into the current and future landscape of mortgage technology amidst the evolving state of the economy and market trends.

Tag: Mike Fratantoni

State of the Market: Tech Trends Shaping the Future of Mortgage Lending–May 13

About the EventThis is a sponsored webinar. Please be advised your contact information will be shared with the sponsor.Join us for an exclusive deep dive into the current and future …

FOMC Holds Rates Steady; MBA Economist Weighs In

The Federal Reserve’s Federal Open Market Committee left interest rates unchanged Jan. 29.

An Appreciation of Housing Policy Expert John C. Weicher

Former Assistant Secretary for Housing and Federal Housing Commissioner John C. Weicher passed away Dec. 10, 2024.

FOMC Cuts Interest Rates; MBA Economist Weighs In

The Federal Reserve’s Federal Open Market Committee cut interest rates by 25 basis points Wednesday in its third consecutive reduction. The market had anticipated the change.

Fed Cuts Interest Rates 25 Basis Points; MBA Economist Weighs In

The Federal Reserve cut interest rates by 25 basis points Nov. 7.

MBA Forecast: Mortgage Originations to Increase 28% to $2.3 Trillion in 2025

DENVER–The Mortgage Bankers Association announced at its 2024 Annual Convention & Expo that total mortgage origination volume is expected to increase to $2.3 trillion in 2025 from the $1.79 trillion expected in 2024.

Fed Cuts Interest Rates 50 Basis Points; MBA Economist Weighs In

The Federal Reserve cut interest rates by 50 basis points Sept. 18.

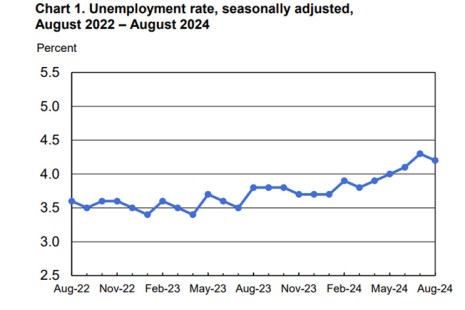

142,000 Jobs Added in August, Unemployment Rate Stagnant

The U.S. Bureau of Labor Statistics released jobs data from August, finding that total nonfarm payroll enrollment increased by 142,000. The unemployment rate changed little at 4.2%.

MBA Chart of the Week: Monthly Payroll Growth and Unemployment Rate

The job market definitively slowed in July. Nonfarm payroll growth at 114,000 was well below the 12-month average of 215,000, while the unemployment rate moved up to its highest level since October 2021 at 4.3%, as shown in this week’s chart.