MBA announced that Judith Ricks has joined the association as Associate Vice President, Commercial Real Estate Research. In this role, Ricks will develop and oversee MBA’s extensive research and analysis that covers commercial real estate finance markets.

Tag: Mike Fratantoni

Fannie Mae HPES Predicts Home Price Growth Will Moderate

Fannie Mae, in partnership with Pulsenomics, Acton, Mass., released its Home Price Expectations Survey for the first quarter.

State of the Market: Tech Trends Shaping the Future of Mortgage Lending–May 13

Join us for an exclusive deep dive into the current and future landscape of mortgage technology amidst the evolving state of the economy and market trends.

U.S. Adds 228,000 Jobs in March; Industry Economists Weigh In

Total nonfarm payroll increased by 228,000 in March, the U.S. Bureau of Labor Statistics reported.

Chart of the Week: Commercial and Multifamily Mortgage Debt Outstanding

According to MBA’s Quarterly Mortgage Debt Outstanding Report, total commercial and multifamily mortgage debt outstanding increased by 3.7% year-over-year, rising from $4.62 trillion in Q4 2023 to $4.79 trillion in Q4 2024. This growth reflects continued investment in commercial real estate, with sector-specific variations in debt allocation.

FOMC Rate Pause Remains; MBA Economist Weighs In

The Federal Reserve’s Federal Open Market Committee left interest rates unchanged on Wednesday.

MBA: Commercial and Multifamily Mortgage Delinquency Rates Increased in Fourth-Quarter 2024

Commercial mortgage delinquencies increased in the fourth quarter of 2024, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report.

Commercial, Multifamily Mortgage Debt Outstanding Increased in Fourth Quarter

The level of commercial and multifamily mortgage debt outstanding at the end of 2024 was $172 billion higher than at the end of 2023, MBA reported.

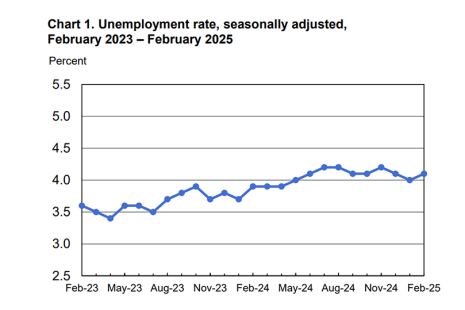

Jobs Up by 151,000 in February; Unemployment Rate Ticks Up

The Bureau of Labor Statistics released February employment numbers, finding total nonfarm payroll rose by 151,000 in February.

State of the Market: Tech Trends Shaping the Future of Mortgage Lending–May 13

Join us for an exclusive deep dive into the current and future landscape of mortgage technology amidst the evolving state of the economy and market trends.