WASHINGTON–The industry has plentiful challenges, but is in a very different spot than during the Great Recession, said Michael Fratantoni, Mortgage Bankers Association Chief Economist and Senior Vice President of Research and Industry Technology, here at the National Advocacy Conference.

Tag: Mike Fratantoni

Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 9.7% from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending March 1, 2024.

Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.6% from one week earlier, according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending Feb. 23, 2024.

Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 10.6% from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending Feb. 16, 2024.

Mohamed El-Erian at #MBACREF24: U.S. Economy Outshines Rest of World

SAN DIEGO–Looking at the U.S. economy, 2024 will be solid, but not as solid as last year, predicted Mohamed El-Erian during a session titled “What’s Ahead in the Global Economy” Feb. 12 at the MBA Commercial/Multifamily Finance Convention and Expo.

Fratantoni to Share Market Outlook at MBA Secondary & Capital Markets Conference & Expo May 20

Arm yourself with the information you need to achieve your business and performance goals. Make plans to be in New York City at MBA’s Secondary & Capital Markets Conference & Expo May 19 – 22.

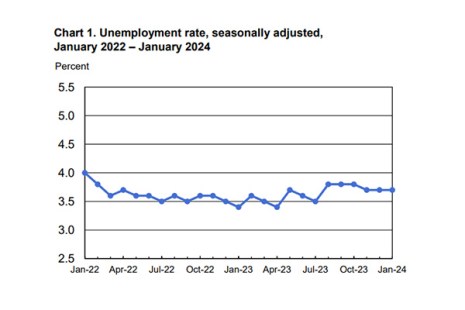

U.S. Economy Adds 353,000 Jobs in January

Total nonfarm payroll employment rose by 353,000 in January, with the unemployment rate flat at 3.7%, the Bureau of Labor Statistics reported Feb. 2.

Fed Holds Rates Steady

The Federal Open Market Committee held rates steady on Wednesday, stating that “the risks to achieving its employment and inflation goals are moving into better balance”

MBA’s Mike Fratantoni, Industry Execs Share 2024 Predictions, Advice

Mike Fratantoni, MBA Chief Economist and Senior Vice President of Research and Industry Technology, continued to forecast 2024 growth in both purchases and refinances while speaking on a Jan. 16 webinar panel hosted by Snapdocs, Covina, Calif.

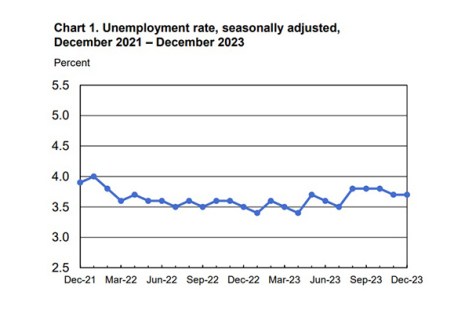

Job Market Grows by 216,000 in December

The job market held steady in December, with growth in payrolls of 216,000 and the unemployment rate unchanged at 3.7%, the U.S. Bureau of Labor Statistics reported Friday.