Mortgage applications decreased 3.7 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending September 23, 2022.

Tag: MBA Weekly Applications Survey

MBA Weekly Survey Sept. 28, 2022: Applications Decrease

Mortgage applications decreased 3.7 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending September 23, 2022.

MBA: August Homebuyer Affordability Up 3rd Straight Month

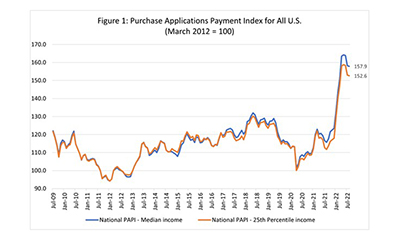

Homebuyer affordability improved in August for the third straight month, with the national median payment applied for by applicants decreasing to $1,839 from $1,844 in July, according to the Mortgage Bankers Association’s Purchase Applications Payment Index.

MBA: August Homebuyer Affordability Up 3rd Straight Month

Homebuyer affordability improved in August for the third straight month, with the national median payment applied for by applicants decreasing to $1,839 from $1,844 in July, according to the Mortgage Bankers Association’s Purchase Applications Payment Index.

Staying Put: 85% of Homeowners with Mortgages Have Rate Far Below Current Level

With mortgage interest rates pushing well above 6 percent—the Mortgage Bankers Association on Wednesday reported 30-year rates up by 24 basis points to 6.25%–a growing number of homeowners are reluctant to sell because they have a lower rate locked in, said Redfin, Seattle.

MBA Weekly Survey Sept. 21, 2022: Applications, Interest Rates Rise

Mortgage applications rose for the first time in six weeks despite another sharp jump in mortgage interest rates, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending Sept. 16.

MBA Weekly Survey Sept. 21, 2022: Applications, Interest Rates Rise

Mortgage applications rose for the first time in six weeks despite another sharp jump in mortgage interest rates, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending Sept. 16.

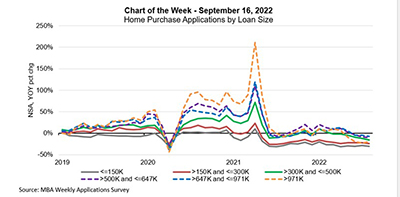

MBA Chart of the Week, Sept. 16, 2022: Home Purchase Applications by Loan Size

The housing market continues to face challenges from economic uncertainty, high home-price growth and volatile mortgage rates. MBA’s Weekly Applications Survey data show that overall mortgage application activity continues to trend lower, as refinances have quickly dried up due to rates rising throughout the year and hitting the 6-percent mark for the first time since 2008.

MBA Chart of the Week, Sept. 16, 2022: Home Purchase Applications by Loan Size

The housing market continues to face challenges from economic uncertainty, high home-price growth and volatile mortgage rates. MBA’s Weekly Applications Survey data show that overall mortgage application activity continues to trend lower, as refinances have quickly dried up due to rates rising throughout the year and hitting the 6-percent mark for the first time since 2008.

MBA Weekly Survey Sept. 14, 2022: Applications Fall 6th Straight Week; Interest Rates Top 6%

Mortgage applications fell for the sixth straight week as interest rates topped 6 percent, although purchase applications showed signs of life, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending Sept. 9.