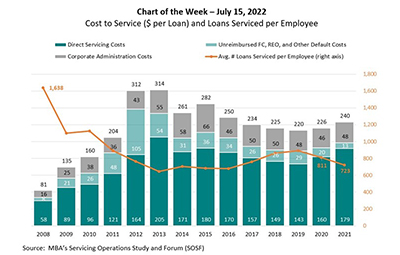

MBA’s annual Servicing Operations Study and Forum includes a deep-dive analysis and discussion of servicing costs, productivity, portfolio activity and operational metrics for in‐house servicers. This week’s MBA Chart of the Week shows 2021 fully loaded servicing costs, which include three components: direct expenses; unreimbursed foreclosure, REO and other default costs; and corporate administration costs.

Tag: MBA Servicing Operations Study and Forum

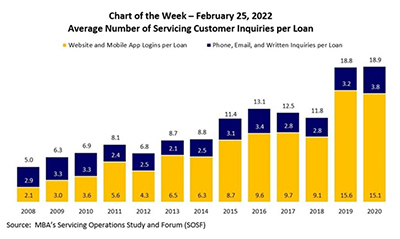

MBA Chart of the Week: Servicing Customer Inquiries Per Loan

In this week’s MBA Chart of the Week, we focus on borrower communications, specifically the average number of annual servicing customer inquiries per loan. MBA has tracked this data through its Servicing Operations Study and Forum since 2008.

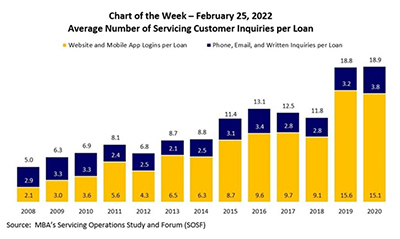

MBA Chart of the Week: Servicing Customer Inquiries Per Loan

In this week’s MBA Chart of the Week, we focus on borrower communications, specifically the average number of annual servicing customer inquiries per loan. MBA has tracked this data through its Servicing Operations Study and Forum since 2008.

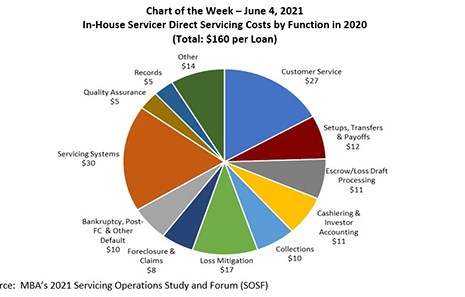

MBA Chart of the Week June 7, 2021: In-House Servicer Direct Servicing Costs by Function in 2020

MBA Research recently wrapped up its annual Servicing Operations Study, a deep dive analysis of servicing costs, productivity, portfolio activity and operational metrics for in-house servicers. In this week’s chart, we show 2020 direct servicing costs allocated by functional area.

#MBAServicing2020: For Servicing Industry, A Cautious Economic Outlook

ORLANDO—Low mortgage rates, improved home-building rates and a growing number of people aspiring to homeownership makes for an optimistic formula for the mortgage servicing industry, said Mortgage Bankers Association economists, despite some potential headwinds in the short term.

#MBAServicing2020: For Servicing Industry, A Cautious Economic Outlook

ORLANDO—Low mortgage rates, improved home-building rates and a growing number of people aspiring to homeownership makes for an optimistic formula for the mortgage servicing industry, said Mortgage Bankers Association economists, despite some potential headwinds in the short term.