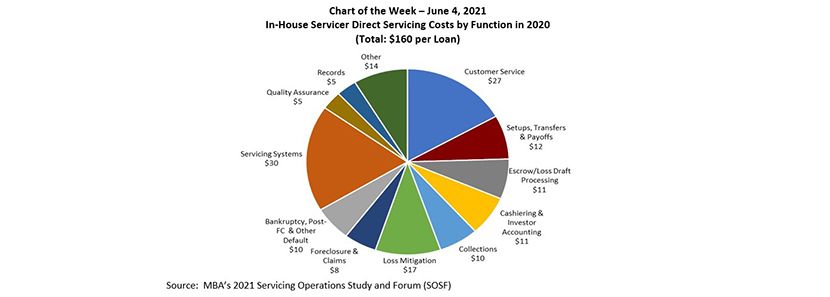

MBA Chart of the Week June 7, 2021: In-House Servicer Direct Servicing Costs by Function in 2020

MBA Research recently wrapped up its annual Servicing Operations Study, a deep dive analysis of servicing costs, productivity, portfolio activity and operational metrics for in-house servicers. In this week’s chart, we show 2020 direct servicing costs allocated by functional area.

After four consecutive years of decline, total direct servicing costs reached $160 per loan in 2020, up from $143 per loan in 2019. However, year-over-year changes in functional costs were not consistently higher. Non-default functional categories combined to $115 per loan in 2020 from $99 per loan in 2019. Default-specific functional categories combined to $45 per loan in 2020 from $44 per loan in 2019.

While mortgage delinquencies were up in 2020, forbearance activity and foreclosure moratoria put a hold on some default-related activities such as foreclosures and claims, resulting in relatively flat overall default costs. At the same time, servicing costs grew the most in areas, such as servicing systems; customer service; and setups, transfers and payoffs. These were the areas most immediately impacted by heavy servicing portfolio churn, increased borrower inquiries, the initial spike in forbearance requests, employee movement to remote work and operationalizing new or amended investor requirements.

Note: Direct servicing costs are defined as personnel, occupancy and equipment, and other costs needed to service residential mortgages. These direct costs exclude 1) unreimbursed foreclosure and REO costs, which cover servicer penalties, compensatory fees as well as mortgage product‐specific foreclosure costs for which the servicer is responsible, such as a portion of the attorney fees for FHA loans; 2) corporate costs for legal, finance, human resources, network administration, parent allocations etc.; and 3) prepayment interest shortfall or any interest expense on financing servicing advances or mortgage servicing rights.

–Marina Walsh, CMB mwalsh@mba.org.