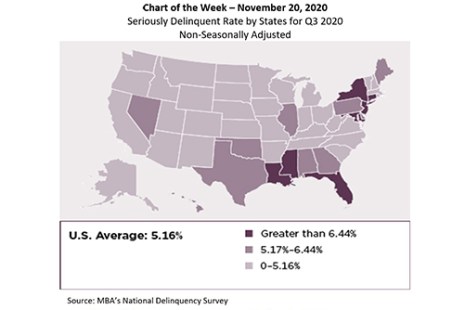

MBA released its National Delinquency Survey results for the third quarter last week. This week’s chart highlights the seriously delinquent rate – the percentage of loans that are 90 days or more delinquent or in the process of foreclosure – in every state across the country.

Tag: MBA National Delinquency Survey

MBA: Mortgage Delinquencies Decrease in 3Q

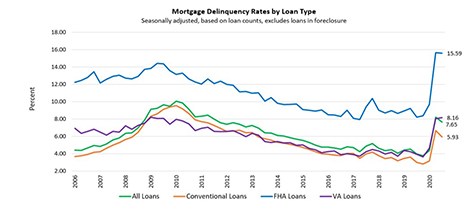

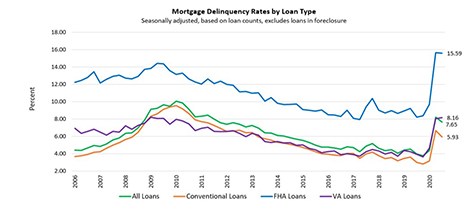

Mortgage delinquency and foreclosure rates fell in the third quarter, the Mortgage Bankers Association reported Tuesday in its quarterly National Delinquency Survey.

MBA: Mortgage Delinquencies Decrease in 3Q

Mortgage delinquency and foreclosure rates fell in the third quarter, the Mortgage Bankers Association reported today in its quarterly National Delinquency Survey.

CoreLogic: Foreclosures Remain Low; Serious Delinquencies Continue to Build Up

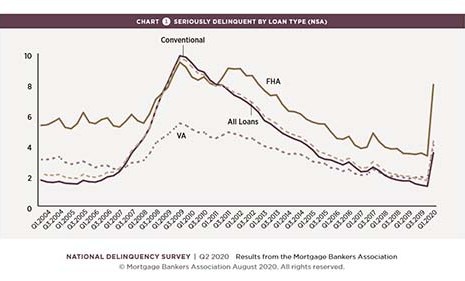

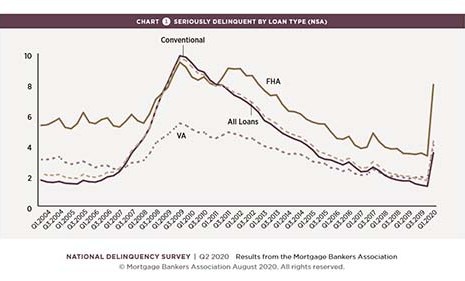

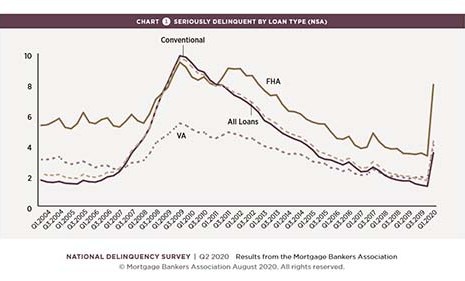

Ahead of this morning’s quarterly National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said the 150-day delinquency rate reached its highest level since January 1999, noting that forbearance provisions have helped foreclosure rates maintain historic lows.

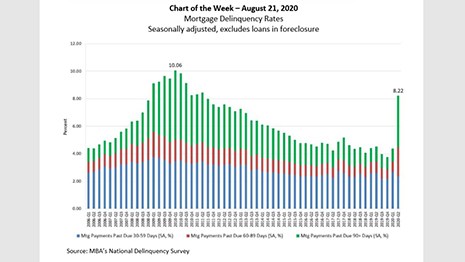

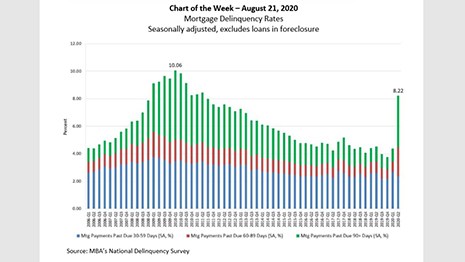

MBA Chart of the Week: Mortgage Delinquency Rates

MBA released its National Delinquency Survey results for the second quarter last week. Key findings revealed that the COVID-19 pandemic’s effects on some homeowners’ ability to make their mortgage payments could not be more apparent.

MBA Chart of the Week: Mortgage Delinquency Rates

MBA released its National Delinquency Survey results for the second quarter last week. Key findings revealed that the COVID-19 pandemic’s effects on some homeowners’ ability to make their mortgage payments could not be more apparent.

MBA: Mortgage Delinquencies Spike in Second Quarter

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.

MBA: Mortgage Delinquencies Spike in Second Quarter

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.

MBA: Mortgage Delinquencies Spike in Second Quarter

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.

The Week Ahead–Aug. 17, 2020

Good morning! August is usually a quiet time in Washington—so quiet, that not too many years ago, MBA NewsLink would take a week-long break during the month and not miss a thing. That’s not the case these days.