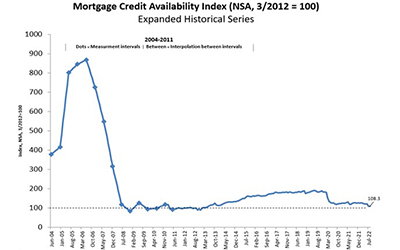

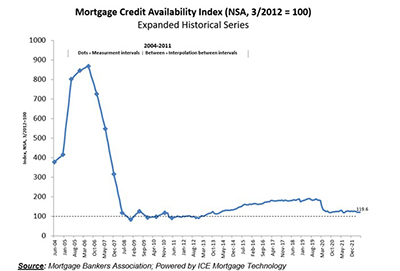

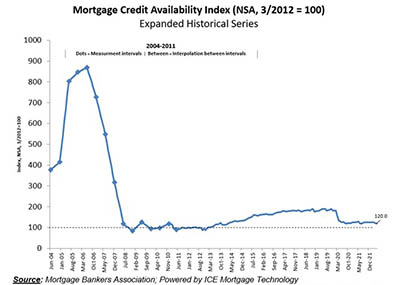

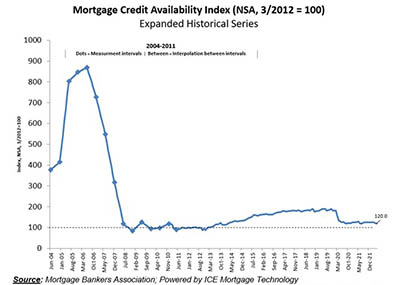

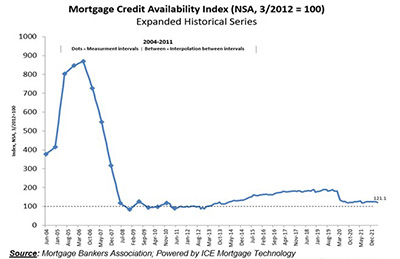

Mortgage credit availability fell for the sixth straight month in August, remaining at its lowest level in nine years, the Mortgage Bankers Association reported Tuesday.

Tag: MBA Mortgage Credit Availability Index

Mortgage Credit Availability Falls for 6th Straight Month

Mortgage credit availability fell for the sixth straight month in August, remaining at its lowest level in nine years, the Mortgage Bankers Association reported Tuesday.

The Week Ahead, Sept. 12, 2022: What You Need to Know

NASHVILLE, TENN.—Good morning and happy Monday! MBA NewsLink comes to you here from the MBA Risk Management, QA and Fraud Prevention Forum.

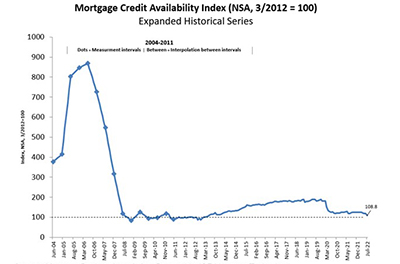

July Mortgage Credit Availability at 9-Year Low

Mortgage credit availability fell for the fifth straight month in July to its lowest level in nine years, the Mortgage Bankers Association reported Tuesday.

July Mortgage Credit Availability at 9-Year Low

Mortgage credit availability fell for the fifth straight month in July to its lowest level in nine years, the Mortgage Bankers Association reported Tuesday.

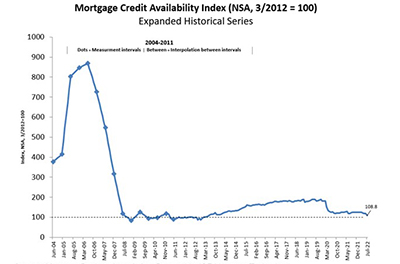

June Mortgage Credit Availability Declines

Mortgage credit availability fell for the fourth straight month in June amid rising interest rates, the Mortgage Bankers Association reported Tuesday.

June Mortgage Credit Availability Declines

Mortgage credit availability fell for the fourth straight month in June amid rising interest rates, the Mortgage Bankers Association reported Tuesday.

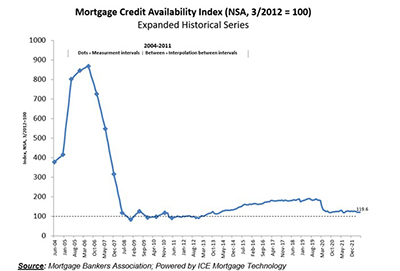

Mortgage Credit Availability Falls 3rd Straight Month

Mortgage credit availability fell for the third straight month in May to its lowest level since last July, hamstrung by tightening in mortgage refinance loans, the Mortgage Bankers Association reported Thursday.

Mortgage Credit Availability Falls 3rd Straight Month

Mortgage credit availability fell for the third straight month in May to its lowest level since last July, hamstrung by tightening in mortgage refinance loans, the Mortgage Bankers Association reported Thursday.

April Mortgage Credit Availability Slips

Mortgage credit availability fell in April, the second straight monthly decrease, the Mortgage Bankers Association reported Tuesday.