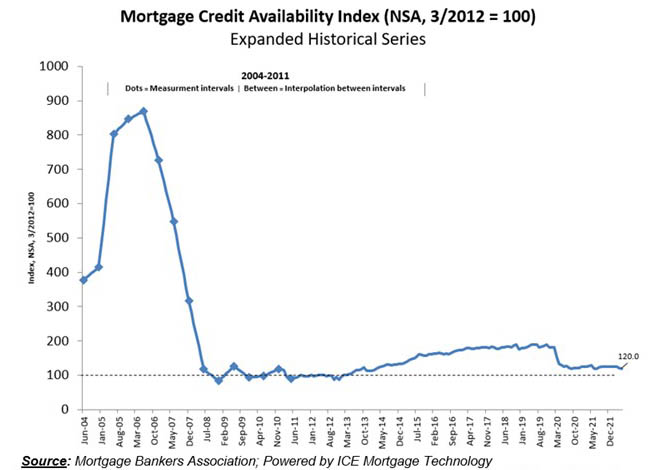

Mortgage Credit Availability Falls 3rd Straight Month

Mortgage credit availability fell for the third straight month in May to its lowest level since last July, hamstrung by tightening in mortgage refinance loans, the Mortgage Bankers Association reported Thursday.

The MBA Mortgage Credit Availability Index fell by 0.9 percent to 120.0 in May. The Conventional MCAI decreased 0.4 percent, while the Government MCAI decreased by 1.3 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 1.1 percent, and the Conforming MCAI rose by 1.0 percent.

“The index remains more than 30 percent below pre-pandemic levels, as credit tightening has occurred in recent months around refinance loan programs,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “Last month’s tightening was most notable in the government and jumbo segments of the mortgage market. The decrease in government credit was driven mainly by a reduction in streamline refinance programs, as mortgage rates increased sharply through May, slowing refinance activity. Jumbo credit availability, which was starting to see a more meaningful recovery from 2020’s pullback, declined after three months of expansion.”

The report analyzes data from Ellie Mae’s AllRegs® Market Clarity® business information tool. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

About the Mortgage Credit Availability Index

The MCAI provides the only standardized quantitative index solely focused on mortgage credit.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for more than 95 lenders/investors are combined by MBA using data made available via the AllRegs Market Clarity product and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.

To learn more about the ICE Mortgage Technology AllRegs Market Clarity platform, visit http://answers.allregs.com/MCAI-Market-Clarity. For more information on the Mortgage Credit Availability Index, including Methodology, Frequently Asked Questions and other helpful resources, visit www.mba.org/MortgageCredit or contact MBAResearch@mba.org.