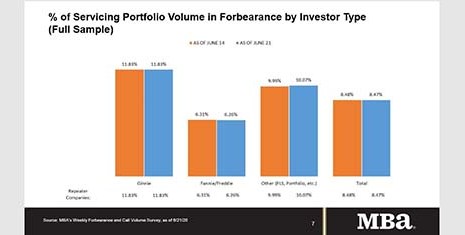

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 8.47%of servicers’ portfolio volume as of June 21, a slight decrease from 8.48% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

Tag: MBA Forbearance and Call Volume Survey

MBA: Shares of Loans in Forbearance Falls to 8.48%

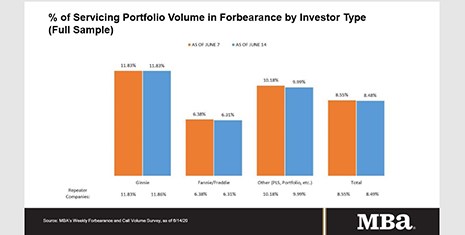

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased – for the first time since the survey’s inception in March – from 8.55% of servicers’ portfolio volume in the prior week to 8.48% as of June 14.

MBA: Share of Mortgage Loans in Forbearance Falls to 8.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased – for the first time since the survey’s inception in March – from 8.55% of servicers’ portfolio volume in the prior week to 8.48% as of June 14.

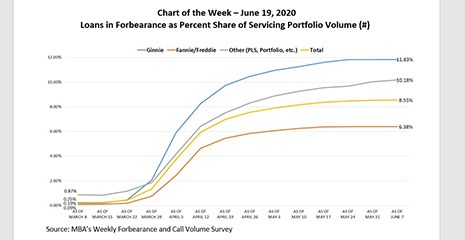

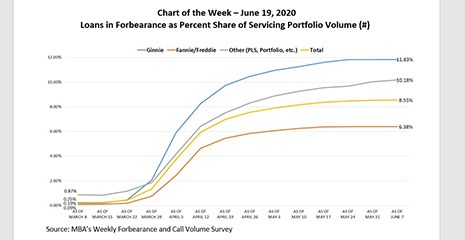

MBA Chart of the Week: Loans in Forbearance as Share of Servicing Portfolio Volume

This week’s chart shows the course of the share of loans in forbearance by investor type over the past three months – from the earliest stages of the COVID-19 pandemic to the most recent reporting.

MBA Chart of the Week: Loans in Forbearance as Share of Servicing Portfolio Volume

This week’s chart shows the course of the share of loans in forbearance by investor type over the past three months – from the earliest stages of the COVID-19 pandemic to the most recent reporting.

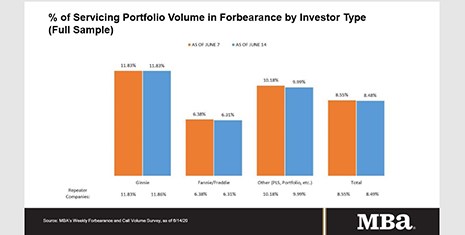

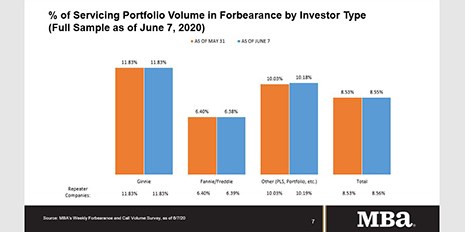

MBA: Share of Mortgage Loans in Forbearance Levels Out at 8.55%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey said loans now in forbearance increased just slightly, to 8.55% of servicers’ portfolio volume as of June 7 compared to 8.53% the prior week. MBA now estimates 4.3 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Levels Out at 8.55%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey said loans now in forbearance increased just slightly, to 8.55% of servicers’ portfolio volume as of June 7 compared to 8.53% the prior week. MBA now estimates 4.3 million homeowners are in forbearance plans.

MBA, Trade Groups Urge HUD to Modify FHA Forbearance Indemnification Policy

Sixteen industry trade organizations joined the Mortgage Bankers Association in a letter this week to HUD, expressing concerns with a recently announced FHA policy requiring lenders to provide 20 percent indemnification of the original loan amount for up to two years in relation to borrowers who enter into forbearance due to COVID19-related hardship after closing and prior to FHA insuring their loan.

MBA, Trade Groups Urge HUD to Modify FHA Forbearance Indemnification Policy

Sixteen industry trade organizations joined the Mortgage Bankers Association in a letter this week to HUD, expressing concerns with a recently announced FHA policy requiring lenders to provide 20 percent indemnification of the original loan amount for up to two years in relation to borrowers who enter into forbearance due to COVID19-related hardship after closing and prior to FHA insuring their loan.

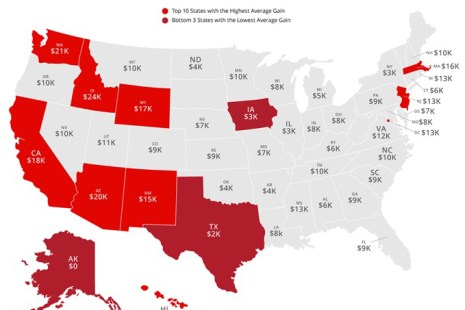

CoreLogic: Borrowers Gain $6 Trillion in Home Equity Since End of Great Recession

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages—representing 63% of all properties—have seen their equity increase by 6.5% year over year, representing a gain of $590 billion since 2019.