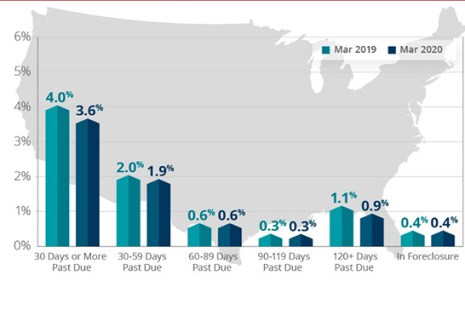

CoreLogic, Irvine, Calif., said its analysis of March mortgage delinquencies and foreclosures found despite the early impact of the coronavirus pandemic, delinquencies remained relatively low.

Tag: MBA Forbearance and Call Volume Survey

MBA Survey: Share of Mortgage Loans in Forbearance Slows to 8.53%

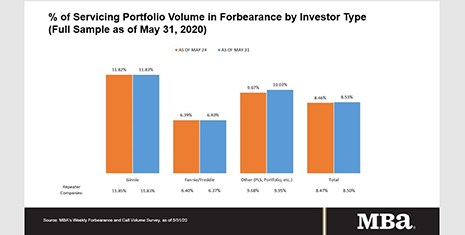

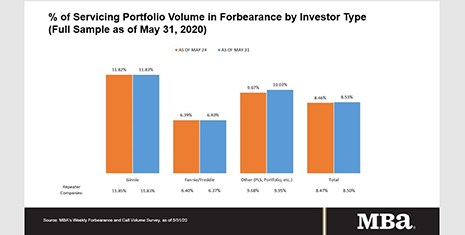

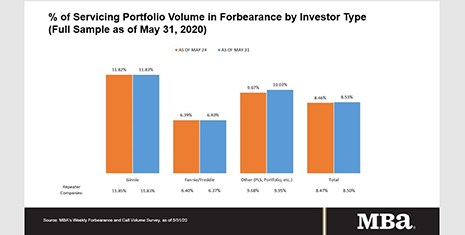

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.53% of mortgage servicers’ portfolio volume as of May 31, compared to 8.46% the prior week. MBA now estimates nearly 4.3 million homeowners are in forbearance plans.

MBA Survey: Share of Mortgage Loans in Forbearance Slows to 8.53%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.53% of mortgage servicers’ portfolio volume as of May 31, compared to 8.46% the prior week. MBA now estimates nearly 4.3 million homeowners are in forbearance plans.

MBA Survey: Share of Mortgage Loans in Forbearance Increases to 8.53%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.53% of mortgage servicers’ portfolio volume as of May 31, compared to 8.46% the prior week. MBA now estimates nearly 4.3 million homeowners are in forbearance plans.

MBA Advocacy Update: June 8, 2020

MBA remains actively engaged with decision-makers at all levels of government to help shape the response to the effects of the pandemic on the mortgage market. Last week, the Senate passed legislation that would ease restrictions on the SBA’s Paycheck Protection Program, which President Trump signed into law on Friday.

The Week Ahead: June 8, 2020

Good morning! Welcome to Month Four of the Coronapocalypse. This afternoon, the Mortgage Bankers Association releases its weekly Forbearance & Call Volume Report at 4:00 p.m. ET; MBA NewsLink will provide a special afternoon issue with the results.

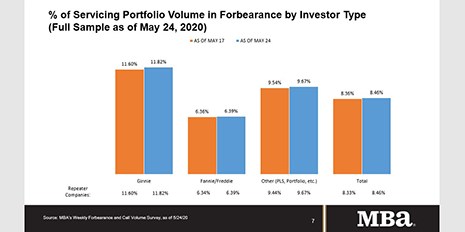

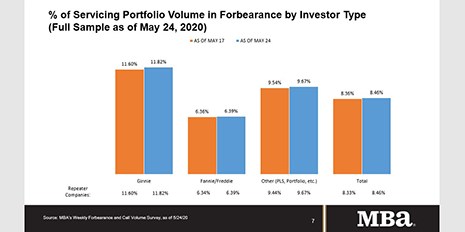

MBA: Share of Mortgage Loans in Forbearance Increases to 8.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.46% of servicers’ portfolio volume from 8.36% the prior week as of May 24. MBA estimates 4.2 million homeowners are now in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 8.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.46% of servicers’ portfolio volume from 8.36% the prior week as of May 24. MBA estimates 4.2 million homeowners are now in forbearance plans.

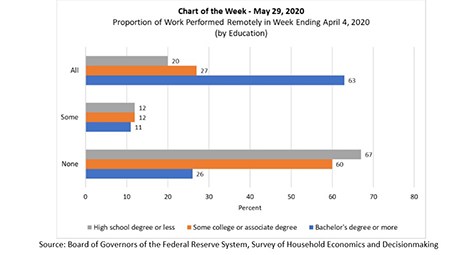

MBA Chart of the Week: Proportion of Work Being Performed Remotely

MBA’s Chart of the Week three weeks ago (May 8) focused on the U.S. Bureau of Labor Statistics’ bleak April report on employment conditions. We examined which industries and sectors have been hardest hit by the COVID-19 pandemic. This week, we continue our examination of the labor market using new survey data released by the Federal Reserve Board, and examine, by education level, how many people were able to work from home as the crisis deepened in early April.

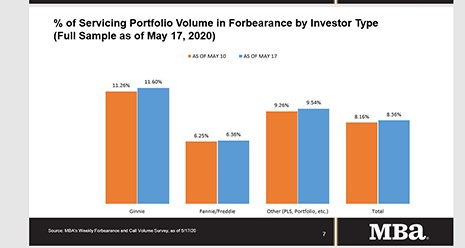

MBA: Share of Mortgage Loans in Forbearance Increases to 8.36%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased to 8.36% of mortgage servicer volume as of May 17, up from 8.16% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.