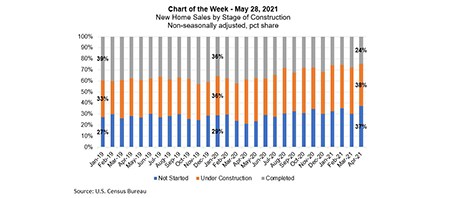

This week’s MBA Chart of the Week shows that there is a declining share of completed homes (24 percent) and a growing share of homes sold that were either still under construction (38 percent) or not started (37 percent).

Tag: MBA Chart of the Week

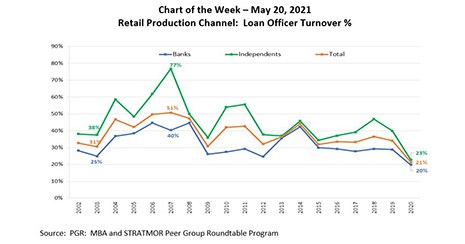

MBA Chart of the Week May 24 2021: Retail Production Channel Loan Officer Turnover

This week’s chart shows the historical retail Loan Officer turnover rates (%) for depository banks and independent mortgage companies, based on data collected through the MBA and STRATMOR Peer Group Roundtable Program, now in its 23rd year of production.

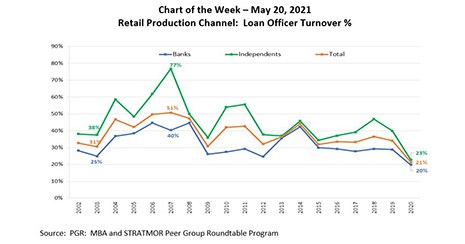

MBA Chart of the Week May 24 2021: Retail Production Channel Loan Officer Turnover

This week’s chart shows the historical retail Loan Officer turnover rates (%) for depository banks and independent mortgage companies, based on data collected through the MBA and STRATMOR Peer Group Roundtable Program, now in its 23rd year of production.

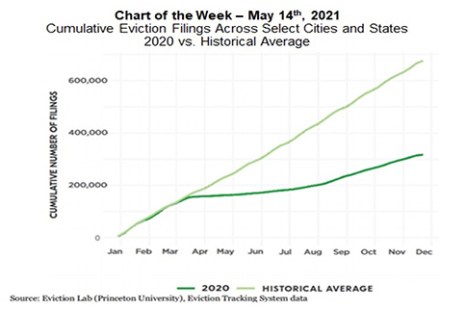

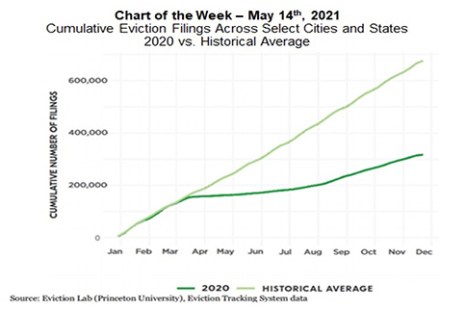

MBA Chart of the Week May 17, 2021: Cumulative Eviction Filings, 2020 v. Historical Average

On Wednesday, May 5, U.S. District Court Judge Dabney Friedrich issued an order vacating the U.S. Centers for Disease Control and Prevention’s national eviction moratorium. But with the number of Covid-19 cases, hospitalizations and deaths falling, increased attention is being paid to when, and how, to allow the various moratoriums to phase-out.

MBA Chart of the Week May 17, 2021: Cumulative Eviction Filings, 2020 v. Historical Average

On Wednesday, May 5, U.S. District Court Judge Dabney Friedrich issued an order vacating the U.S. Centers for Disease Control and Prevention’s national eviction moratorium. But with the number of Covid-19 cases, hospitalizations and deaths falling, increased attention is being paid to when, and how, to allow the various moratoriums to phase-out.

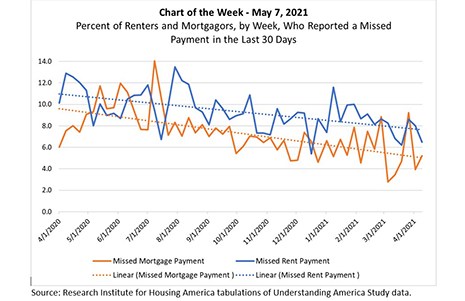

MBA Chart of the Week, May 7, 2021: Renters/Mortgagors & Missed Payments

The Research Institute for Housing America, MBA’s think tank, released updated first-quarter results that allow us to assess how renters, mortgagors and student loan borrowers fared over the first 12 months of the COVID-19 pandemic.

MBA Chart of the Week, May 7, 2021: Renters/Mortgagors & Missed Payments

The Research Institute for Housing America, MBA’s think tank, released updated first-quarter results that allow us to assess how renters, mortgagors and student loan borrowers fared over the first 12 months of the COVID-19 pandemic.

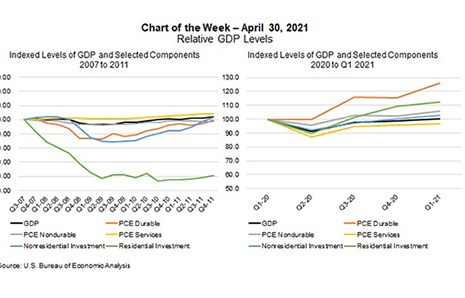

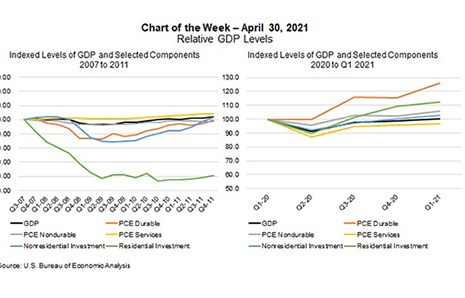

MBA Chart of the Week May 3, 2021: Relative GDP Levels

The pace of economic growth, as measured by gross domestic product in the first quarter, picked up to a 6.4 percent annualized rate – the biggest first-quarter increase since 1984.

MBA Chart of the Week: Relative GDP Levels

The pace of economic growth, as measured by gross domestic product in the first quarter, picked up to a 6.4 percent annualized rate – the biggest first-quarter increase since 1984. We expect that pace to accelerate further over the next 6 months, as households unleash the pent-up demand for a range of goods and services.

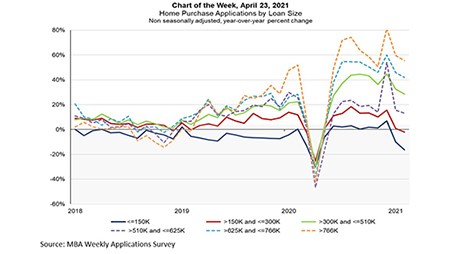

MBA Chart of the Week: Home Purchase Applications By Loan Size

This week’s MBA Chart of the Week examines year-over-year growth in purchase loan applications by loan size since 2018.