Friday’s Employment Situation Summary from the U.S. Bureau of Labor Statistics indicated that job growth remained lackluster in September following similarly disappointing gains in August.

Tag: MBA Chart of the Week

MBA Chart of the Week Oct. 11, 2021–Monthly Payroll Growth

Friday’s Employment Situation Summary from the U.S. Bureau of Labor Statistics indicated that job growth remained lackluster in September following similarly disappointing gains in August.

MBA Chart of the Week Oct. 4, 2021

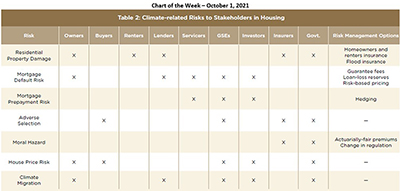

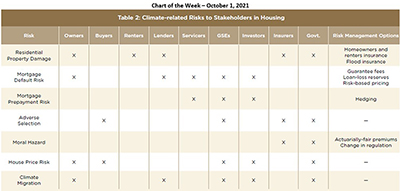

This week’s MBA Chart of the Week lists risks that will likely increase or change because of climate change along with an indication of impacted stakeholders.

MBA Chart of the Week Oct. 4, 2021

This week’s MBA Chart of the Week lists risks that will likely increase or change because of climate change along with an indication of impacted stakeholders.

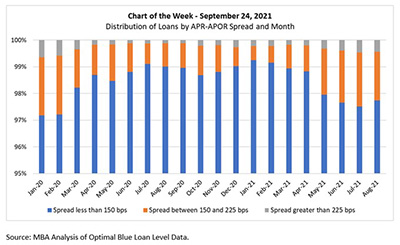

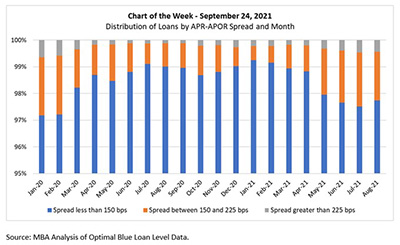

MBA Chart of the Week, Sept. 24, 2021: Distribution of Loans by APR-APOR Spread & Month

In this week’s MBA Chart of the Week, we analyze Optimal Blue single-family, 30-year fixed mortgage rate origination loan data from January 2020 through August 2021. We further group loans in the chart by the spread between their reported note rate and the (monthly average of the) Freddie Mac Primary Mortgage Market Survey rates to approximate the APR-APOR spread.

MBA Chart of the Week, Sept. 24, 2021: Distribution of Loans by APR-APOR Spread & Month

In this week’s MBA Chart of the Week, we analyze Optimal Blue single-family, 30-year fixed mortgage rate origination loan data from January 2020 through August 2021. We further group loans in the chart by the spread between their reported note rate and the (monthly average of the) Freddie Mac Primary Mortgage Market Survey rates to approximate the APR-APOR spread.

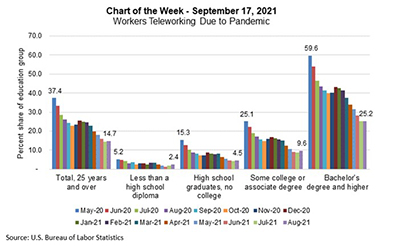

MBA Chart of the Week Sept. 17 2021–Teleworking Due to Pandemic

The COVID-19 pandemic has forced many businesses to change the way they operate, and even 18 months later, there are different views and strategies for the workplace, with teleworking at the center of many discussions.

MBA Chart of the Week Sept. 17 2021–Teleworking Due to Pandemic

The COVID-19 pandemic has forced many businesses to change the way they operate, and even 18 months later, there are different views and strategies for the workplace, with teleworking at the center of many discussions.

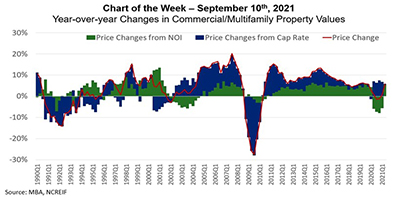

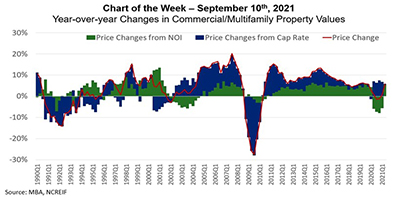

MBA Chart of the Week Sept. 10 2021–Commercial/Multifamily Property Values

Commercial and multifamily property prices are the product of two things: a) the net operating income (NOI) a property produces and/or is expected to produce and b) the multiple of that income (the capitalization or “cap” rate) investors are willing to pay in order to own that income stream.

MBA Chart of the Week Sept. 10 2021–Commercial/Multifamily Property Values

Commercial and multifamily property prices are the product of two things: a) the net operating income (NOI) a property produces and/or is expected to produce and b) the multiple of that income (the capitalization or “cap” rate) investors are willing to pay in order to own that income stream.