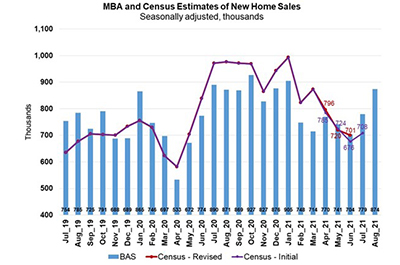

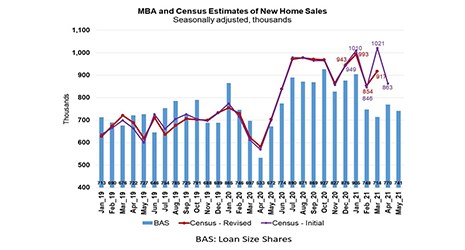

The Mortgage Bankers Association’s latest Builder Applications Survey reported mortgage applications for new home purchases increased by 9 percent in August from July but decreased by 17 percent from a year ago.

Tag: MBA Builder Applications Survey

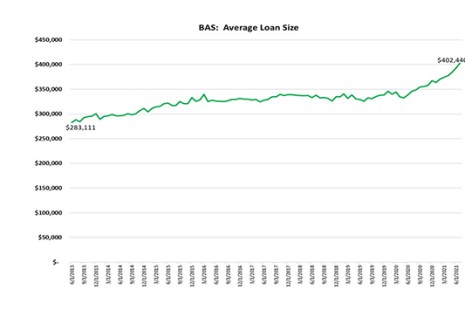

MBA Chart of the Week Sept. 7 2021: Home Price Appreciation, Average Loan Sizes

Home price appreciation continued to accelerate in the second quarter, driven by robust housing demand, which continues to outpace the supply of homes for sale. Some prospective home buyers have taken out larger loans, while others, such as first-time homebuyers or those looking for less expensive homes, have been priced out of the market.

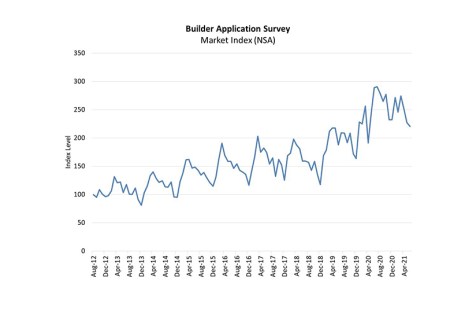

Builder Confidence at 13-Month Low

The National Association of Home Builders said higher construction costs and supply shortages, along with rising home prices pushed builder confidence to its lowest reading since July 2020.

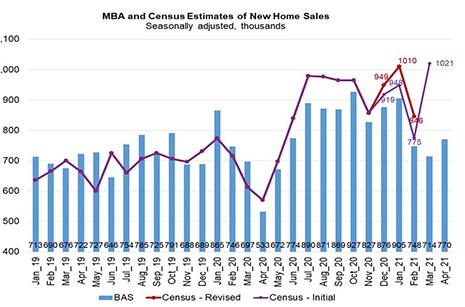

July New Home Purchase Mortgage Applications Down from June

Mortgage applications for new home purchases decreased 27.4 percent compared to a year ago, the Mortgage Bankers Association Builder Application Survey reported.

June New Home Purchase Mortgage Applications Decreased 23.8% Y-o-Y

Mortgage applications for new home purchases decreased 23.8 percent compared to a year ago, the Mortgage Bankers Association’s Builder Application Survey data said.

Quote

“Homebuilders are encountering stronger headwinds of late as severe price increases for key building materials, rising regulatory costs and labor shortages impact their ability to raise production. This has dampened new home sales and quickened home-price growth.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

May New Home Purchase Mortgage Applications Decline

Mortgage applications for new home purchases fell for the second straight month amid tight inventories and sharply rising prices, the Mortgage Bankers Association reported Thursday.

May New Home Purchase Mortgage Applications Decline

Mortgage applications for new home purchases fell for the second straight month amid tight inventories and sharply rising prices, the Mortgage Bankers Association reported Thursday.

Builder Confidence Holds Steady Amid Rising Cost Concerns

Builder confidence held stable in May, despite growing concerns over the price and availability of most building materials, including lumber, the National Association of Home Builders reported Monday.

April New Home Purchase Mortgage Applications Up 31% From Year Ago

The Mortgage Bankers Association’s monthly Builder Applications Survey posted strong annual gains in April, as the spring homebuying season shifted into full gear.