June New Home Purchase Mortgage Applications Decreased 23.8% Y-o-Y

Mortgage applications for new home purchases decreased 23.8 percent compared to a year ago, the Mortgage Bankers Association’s Builder Application Survey data said.

Applications decreased by 3 percent compared to May 2021. This change does not include any adjustment for typical seasonal patterns.

“Homebuilders are encountering stronger headwinds of late, as severe price increases for key building materials, rising regulatory costs and labor shortages impact their ability to raise production,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “This has dampened new home sales and quickened home-price growth.”

“Additionally, still-low levels of for-sale inventory are also pushing prices higher as competition for available units remains high among prospective buyers,” Kan said. He noted applications for new home purchases fell for the third consecutive month, while the average loan amount surged to another record high at $392,370. “In addition to price increases, we are also seeing fewer purchase transactions in the lower price tiers as more of these potential buyers are being priced out of the market, further exerting upward pressure on loan balances,” he said.

Kan said MBA’s estimate of new home sales in June dropped to its lowest annual pace since May 2020 at 704,000 units. The average pace of sales has remained strong at around 738,000 for the past three months, but it is still around 7 percent lower than the average for 2020. Last year was strongest year for new home sales in over a decade, he said.

MBA estimates new single-family home sales were running at a seasonally adjusted annual rate of 704,000 units in June, based on data from the BAS. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

The seasonally adjusted estimate for June is a decrease of 5 percent from the May pace of 741,000 units. On an unadjusted basis, MBA estimates that there were 66,000 new home sales in June 2021, a decrease of 2.9 percent from 68,000 new home sales in May.

By product type, conventional loans composed 74.4 percent of loan applications, FHA loans composed 14.0 percent, RHS/USDA loans composed 1.0 percent and VA loans composed 10.6 percent. The average loan size of new homes increased from $384,323 in May to $392,370 in June.

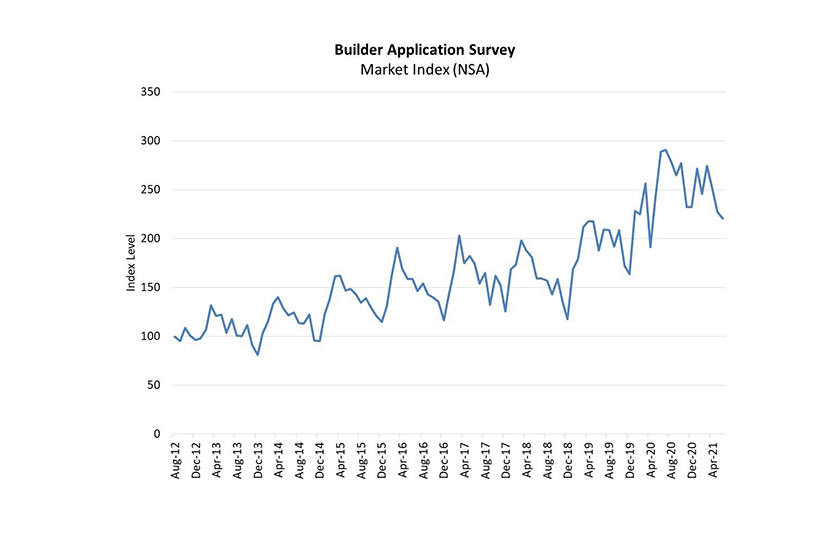

MBA’s Builder Application Survey tracks application volume from mortgage subsidiaries of home builders across the country. Utilizing this data, as well as data from other sources, MBA is able to provide an early estimate of new home sales volumes at the national, state, and metro level. This data also provides information regarding the types of loans used by new home buyers. Official new home sales estimates are conducted by the Census Bureau on a monthly basis. In that data, new home sales are recorded at contract signing, which is typically coincident with the mortgage application. Click here for more information about MBA’s Builder Application Survey.