Here is a summary of recent housing, market and economic reports that have come across the MBA NewsLink desk:

Tag: Mark Fleming

Fed Brings Out the Big Guns

Following weeks of gloomy economic news and rising inflation, the Federal Open Market Committee pulled out nearly all the stops on Wednesday, hiking the federal funds rate by 75 basis points for the first time in nearly 30 years.

Pending Home Sales Fall 6th Straight Month

Pending home sales fell by nearly 4 percent in April—the sixth consecutive monthly drop—the National Association of Realtors reported Thursday.

Housing Market Roundup Apr. 26, 2022

Here is a summary of recent stories of interest to the real estate finance community that have come across the MBA Newslink desk:

Housing Market Roundup: Mar. 31, 2022

Here’s a summary of recent housing market and economic reports that came across the MBA NewsLink desk:

Housing Report Roundup, Mar. 1, 2022

Here are summaries of recent housing market reports that came across the MBA NewsLink desk.

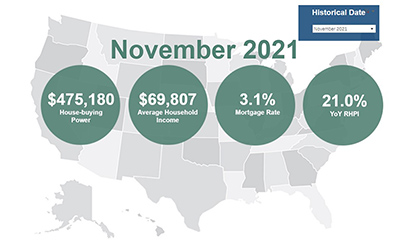

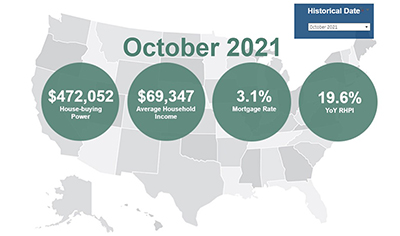

First American: Rising Rates Could Trigger Buyers

Fear of missing out on low rates and the potential loss of house-buying power could supercharge the housing market ahead of the spring home-buying season, said First American Financial Corp., Santa Ana, Calif.

Housing Affordability Concerns Intensify

Reports from First American Financial Corp., Santa Ana, Calif., and ATTOM, Irvine, Calif., show rising home prices and inflation are taking a bigger bite out of housing affordability entering the new year.

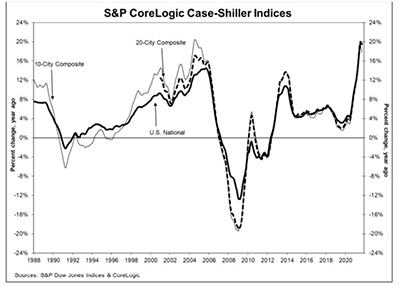

Home Price Report: Double-Digit Growth Pushes On, Though a Bit Slower

A slew of reports Monday confirmed that home price growth continues to move along at a breakneck pace, but show signs of slowing.

First American: House Prices in All 50 Top Markets More Affordable Than Boom Peaks

First American Financial Corp., Santa Ana, Calif., said while house prices have increased, house-buying power has also increased because of a long-run decline in mortgage rates and the slow, but steady growth of household income.