First American: Rising Rates Could Trigger Buyers

Fear of missing out on low rates and the potential loss of house-buying power could supercharge the housing market ahead of the spring home-buying season, said First American Financial Corp., Santa Ana, Calif.

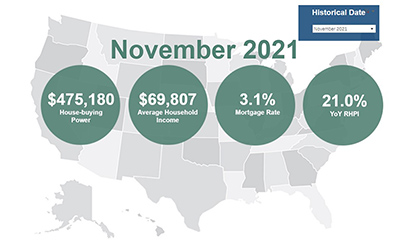

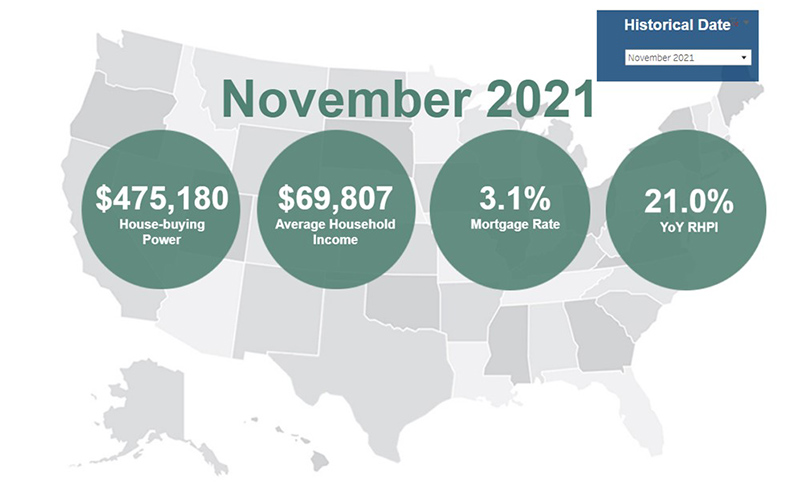

The company’s monthly Real House Price Index reported real house prices increased by 1.5 percent between October and November, and by 21 percent year over year—the highest annual percentage reported by any index.

The report said consumer house-buying power—how much one can buy based on changes in income and interest rates—increased by 0.6 percent between October and November and by 0.4 percent year over year. Median household income has increased 4.4 percent since November 2020 and by 68 percent since January 2000.

The report noted real house prices are 5.6 percent less expensive than in January 2000. While unadjusted house prices are now 42.7 percent above the housing boom peak in 2006, real, house-buying power-adjusted house prices remain 33.8 percent below their 2006 housing boom peak.

“While rates are expected to increase steadily throughout 2022, many potential home buyers may try to jump into the market now before rates rise further,” said First American Chief Economist Mark Fleming. “The fear of missing out, or ‘FOMO,’ on low rates and the potential loss of house-buying power may supercharge the housing market ahead of the spring home-buying season. However, housing supply tends to increase in the spring months as more sellers list their homes for sale. While home buyers may have FOMO because of rising rates, they may not want to succumb to the fear of better options, or ‘FOBO,’ because there may be a better home option or options when there’s more homes for sale, even if it means they may pay more.”

Fleming said affordability is likely to decline further in 2022, because both mortgage rates and nominal house prices are expected to rise. “The Federal Reserve has signaled the end of the easy money era is near,” he said. “Mortgage rates typically follow the same path as long-term bond yields, which are expected to increase due to the Fed’s tightening of monetary policy, higher inflation expectations and an improving economy.”

For example, Fleming said if the average mortgage rate remained at its current level of 3.5 percent through the spring home-buying season, assuming a 5 percent down payment and holding average household income constant at the November level of $69,800, house-buying power falls by $25,000. If rates increase to the anticipated end of 2022 level of 3.7 percent, house-buying power would fall by $36,000. And should mortgage rates reach 4 percent, house-buying power would fall by nearly $52,000 from November.

The report said states with the greatest year-over-year increase in the RHPI were Arizona (+33.1 percent), South Carolina (+28.1 percent), Florida (+28.0), Georgia (+27.4 percent), and Connecticut (+26.2); there were no states with a year-over-year decrease in the RHPI.

Among metros tracked by First American, markets with the greatest year-over-year increase in the RHPI were Phoenix (+34.6 percent), Charlotte, N.C. (+34.0), Tampa, Fla. (+32.0 percent), Atlanta (+30.0 percent) and Jacksonville, Fla. (+29.6 percent). There were no markets with a year-over-year decrease in the RHPI.