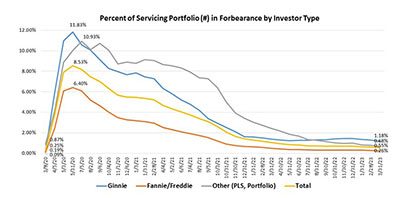

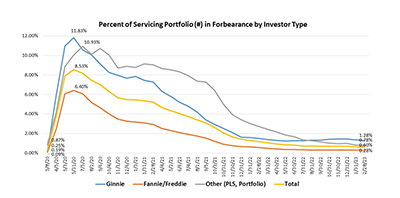

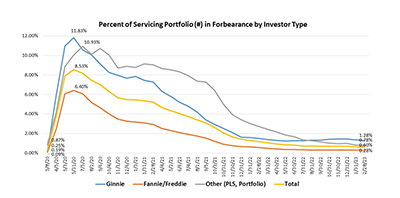

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 5 basis points to 0.55% of servicers’ portfolio volume in March from 0.60% in February.

Tag: Marina Walsh CMB

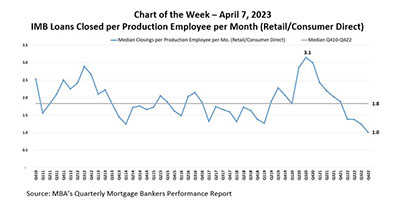

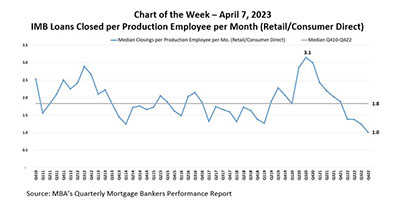

MBA Chart of Week Apr. 7, 2023: IMB Loans Closed Per Production Employee Per Month

In this week’s MBA Chart of the Week, we look at the median productivity of production employees for these independent mortgage bankers, given this drop in production volume.

MBA Chart of Week Apr. 7, 2023: IMB Loans Closed Per Production Employee Per Month

In this week’s MBA Chart of the Week, we look at the median productivity of production employees for these independent mortgage bankers, given this drop in production volume.

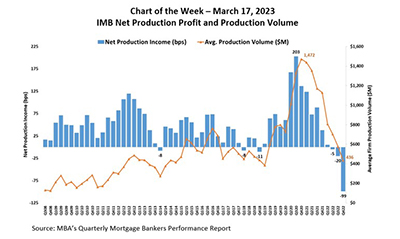

MBA: 2022 IMB Production Profits Fall to Series Low

Independent mortgage banks and mortgage subsidiaries of chartered banks lost an average of $301 on each loan they originated in 2022, down from an average profit of $2,339 per loan in 2021, according to the Mortgage Bankers Association’s Annual Mortgage Bankers Performance Report.

MBA: 2022 IMB Production Profits Fall to Series Low

Independent mortgage banks and mortgage subsidiaries of chartered banks lost an average of $301 on each loan they originated in 2022, down from an average profit of $2,339 per loan in 2021, according to the Mortgage Bankers Association’s Annual Mortgage Bankers Performance Report.

MBA: February Share of Mortgage Loans in Forbearance Decreases to 0.60%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 4 basis points tp 0.60% of servicers’ portfolio volume as of February 28 from 0.64% in January. MBA estimates 300,000 homeowners are in forbearance plans.

MBA: February Share of Mortgage Loans in Forbearance Decreases to 0.60%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 4 basis points tp 0.60% of servicers’ portfolio volume as of February 28 from 0.64% in January. MBA estimates 300,000 homeowners are in forbearance plans.

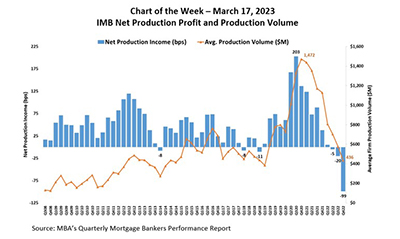

MBA Chart of the Week Mar. 17, 2023: IMB Net Profits, Production Volume

In this MBA Chart of the Week, we look at production profits in basis points, relative to average production volume, from inception of the MBA Quarterly Mortgage Bankers Performance Report series in third quarter 2008 through fourth quarter 2022.

MBA Reports 4Q IMB Net Losses

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net loss of $2,812 on each loan they originated in the fourth quarter, the Mortgage Bankers Association reported Friday.

MBA Chart of the Week Mar. 17, 2023: IMB Net Profits, Production Volume

In this MBA Chart of the Week, we look at production profits in basis points, relative to average production volume, from inception of the MBA Quarterly Mortgage Bankers Performance Report series in third quarter 2008 through fourth quarter 2022.