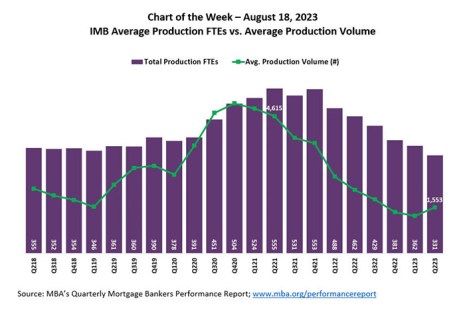

This MBA Chart of the Week compares production personnel to average quarterly production volume in count over the last five years.

Tag: Marina Walsh CMB

MBA: IMBs Report Net Production Losses in the Second Quarter

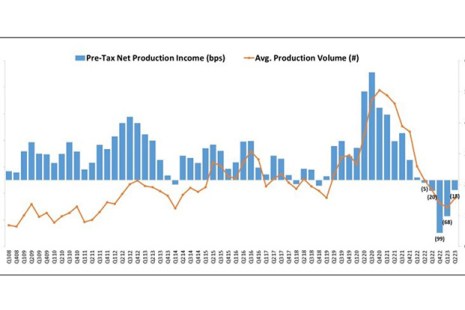

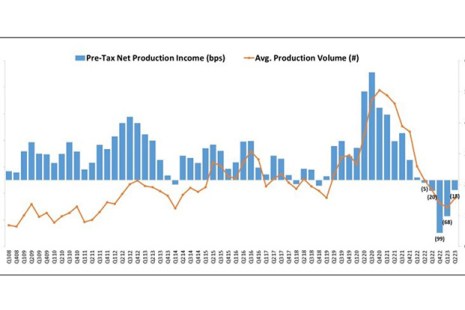

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $534 on each loan they originated in the second quarter, an improvement from the reported loss of $1,972 per loan in the first quarter of 2023, according to the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

MBA: IMBs Report Net Production Losses in the Second Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $534 on each loan they originated in the second quarter, an improvement from the reported loss of $1,972 per loan in the first quarter of 2023, according to the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

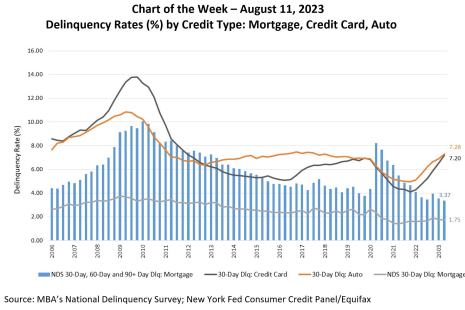

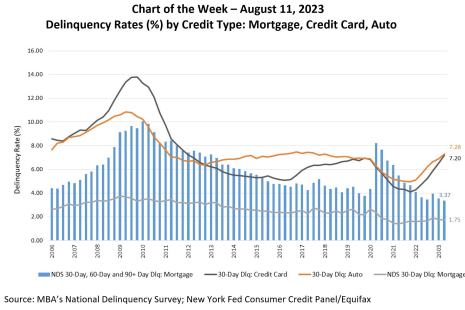

MBA Chart of the Week Aug. 14: Delinquency Rates by Credit Type

According to MBA’s National Delinquency Survey, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties fell to its lowest level since MBA’s survey began in 1979, reaching 3.37 percent in the second quarter.

MBA Chart of the Week Aug. 14: Delinquency Rates by Credit Type

According to MBA’s National Delinquency Survey, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties fell to its lowest level since MBA’s survey began in 1979, reaching 3.37 percent in the second quarter.

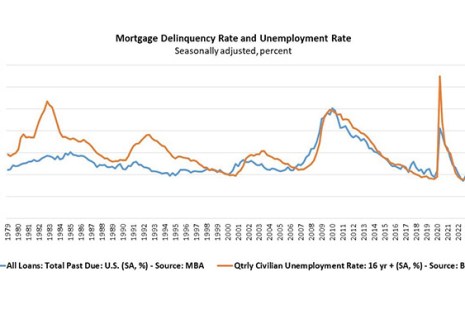

MBA: Mortgage Delinquencies Decrease in Second Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.37 percent of all loans outstanding at the end of the second quarter, according to the Mortgage Bankers Association’s National Delinquency Survey.

MBA: Mortgage Delinquencies Decrease in Second Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.37 percent of all loans outstanding at the end of the second quarter, according to the Mortgage Bankers Association’s National Delinquency Survey.

MBA: Home Equity Lending Volume Rose in 2022 as Home Renovations Drive Demand

Originations of open-ended Home Equity Lines of Credit and closed-end home equity loans increased 50% in 2022 compared to two years earlier. This is according to the Mortgage Bankers Association’s Home Equity Lending Study, released for the first time since 2020.

MBA: Home Equity Lending Volume Rose in 2022 as Home Renovations Drive Demand

Originations of open-ended Home Equity Lines of Credit and closed-end home equity loans increased 50% in 2022 compared to two years earlier. This is according to the Mortgage Bankers Association’s Home Equity Lending Study, released for the first time since 2020.

Quote: July 26, 2023

“Home renovations and remodeling drove demand for home equity products in 2022, with roughly two-thirds of borrowers citing it as a reason for applying for a home equity loan.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.