MBA Chart of the Week Aug. 14: Delinquency Rates by Credit Type

Source: MBA’s National Delinquency Survey; New York Fed Consumer Credit Panel/Equifax

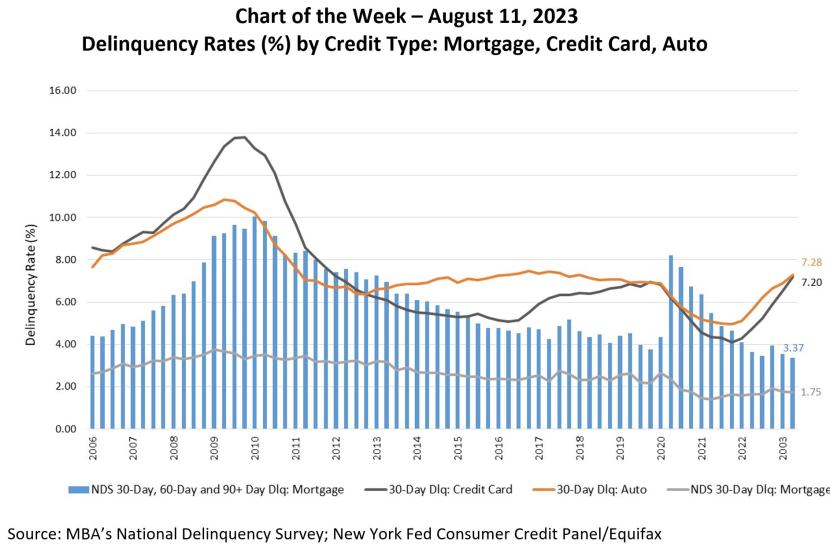

Last week MBA released the latest results from its National Delinquency Survey (NDS). Earlier in the week, the Federal Reserve Bank of New York’s Center for Microeconomic Data issued its latest Quarterly Report on Household Debt and Credit.

According to MBA’s National Delinquency Survey, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties fell to its lowest level since MBA’s survey began in 1979, reaching 3.37 percent in the second quarter of 2023. The delinquency rate was down 19 basis points from the first quarter of 2023 and down 27 basis points from one year ago. Buoyed by a resilient job market, homeowners are continuing to make their mortgage payments.

This week’s Chart of the Week shows that while mortgage delinquencies are at historic lows, data from New York Fed shows that early-stage delinquencies are rising for other forms of credit, specifically credit cards and car loans. The share of credit card balances moving into delinquency rose from 6.51 percent in the first quarter to 7.20 percent in the second quarter of 2023, the highest level since 2012. At the same time, the share of auto loan balances moving into delinquency rose from 6.88 percent in the first quarter to 7.28 percent in the second quarter of 2023, the highest level since 2018. The early-stage delinquencies for credit cards and car loans were well above the 30-day delinquency rate for mortgages and more than double the overall delinquency rate for mortgages, potentially an early sign that some weakness is starting to show in the broader economy.

While rising delinquencies for credit cards and auto loans may signal possible consumer stress, mortgage loan performance has stayed remarkably resilient. Nonetheless, the NDS does reveal that overall delinquencies for FHA borrowers rose 10 basis points from the same quarter a year ago, and earliest-stage FHA delinquencies rose 53 basis points year-over-year. This suggests some additional distress among FHA borrowers compared to the prior year.

Notes on Definitions:

• MBA’s overall delinquency rate tracks the number of loans that are contractually 30 days, 60 days and 90+ days delinquent as of the end of the quarterly reporting period, and excludes loans in foreclosure. It is based on loan count.

• MBA’s 30-day delinquency rate tracks the number of loans that are contractually 30 days delinquent as of the end of the quarterly reporting period. It is based on loan count.

• The NYFED Consumer Credit Panel / Equifax delinquency rate tracks the quarterly flow of debt balances transitioning into early delinquency (30+ days) by credit type.

By Anh Doan and Marina Walsh, CMB