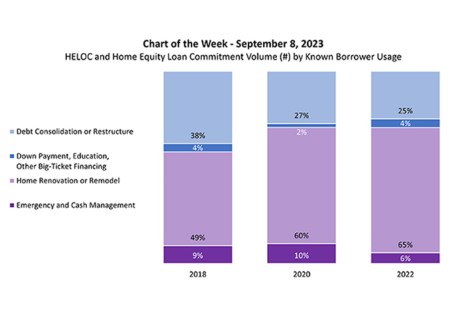

This week’s MBA Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan.

Tag: Marina Walsh CMB

MBA Chart of the Week: HELOC and Home Equity Loan Commitment Volume

This week’s MBA Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan.

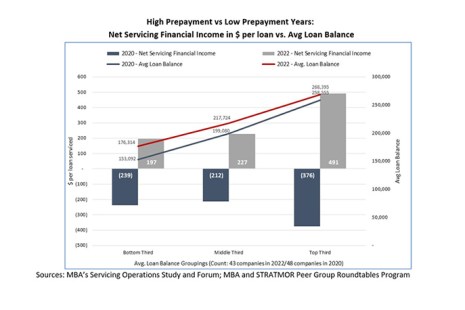

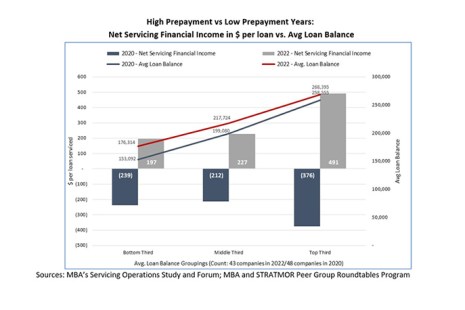

MBA White Paper Measures the Impact of Loan Sizes on Profitability Through Mortgage Cycles

The conventional wisdom is that originating and servicing higher balance loans means higher profits. However, according to a new white paper by the Mortgage Bankers Association titled, How do Mortgage Revenues, Costs and Profitability Vary by Loan Balance? An Analysis Using Benchmarking Data, the relationship between loan balance and profitability is more nuanced and may change over the course of market cycles.

MBA White Paper Measures the Impact of Loan Sizes on Profitability Through Mortgage Cycles

The conventional wisdom is that originating and servicing higher balance loans means higher profits. However, according to a new white paper by the Mortgage Bankers Association titled, How do Mortgage Revenues, Costs and Profitability Vary by Loan Balance? An Analysis Using Benchmarking Data, the relationship between loan balance and profitability is more nuanced and may change over the course of market cycles.

Quote: Sept. 8, 2023

“In recent years, housing inventory constraints and home-price appreciation have resulted in rising average loan balances for single-family homeownership. Yet, financing lower balance loans is an essential way for the mortgage industry to facilitate access to affordable, lower-valued homes.”

–MBA’s Vice President of Industry Analysis Marina Walsh, CMB.

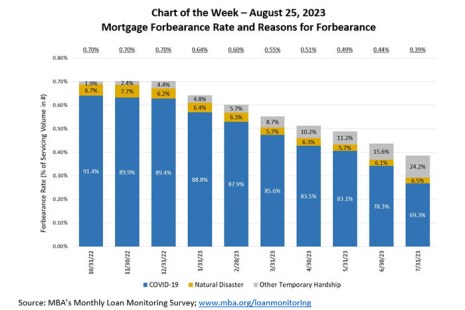

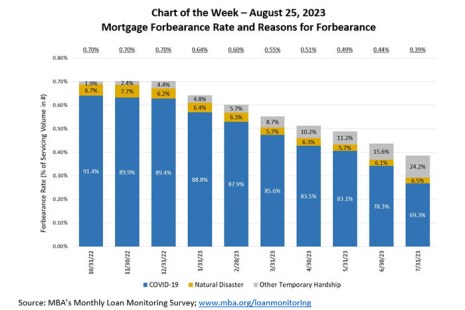

MBA Chart of the Week Aug. 28: Mortgage Forbearance Rate and Reasons for Forbearance

According to the July results from MBA’s Monthly Loan Monitoring Survey, the total number of loans now in forbearance decreased by 5 basis points from 0.44% of servicers’ portfolio volume in the prior month to 0.39% as of July 31, 2023.

MBA Chart of the Week Aug. 28: Mortgage Forbearance Rate and Reasons for Forbearance

According to the July results from MBA’s Monthly Loan Monitoring Survey, the total number of loans now in forbearance decreased by 5 basis points from 0.44% of servicers’ portfolio volume in the prior month to 0.39% as of July 31, 2023.

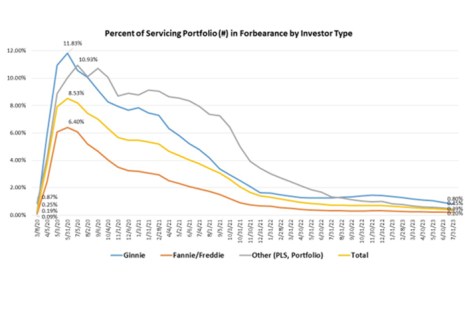

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.39% in July

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance decreased by 5 basis points from 0.44% of servicers’ portfolio volume in the prior month to 0.39% as of July 31.

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.39% in July

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance decreased by 5 basis points from 0.44% of servicers’ portfolio volume in the prior month to 0.39% as of July 31.

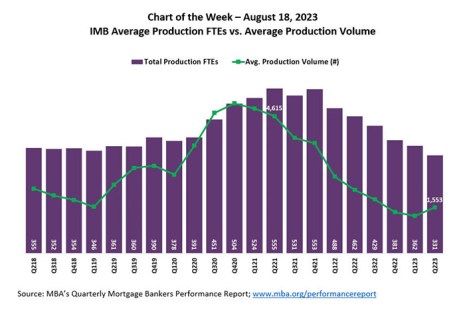

MBA Chart of the Week Aug. 22: Production Personnel and Production Volume

This MBA Chart of the Week compares production personnel to average quarterly production volume in count over the last five years.