SAN DIEGO–The Mortgage Bankers Association said purchase mortgage originations are expected to grow 9% to a record $1.725 trillion in 2022.

Tag: Marina Walsh CMB

Sponsored Content from WFG: MBA Reports of Falling Per-Loan Profits Prompt Calls for Greater Efficiencies

On Aug. 30, Mortgage Professional America reported “Independent mortgage banks and mortgage subsidiaries of chartered banks reported hefty declines in their profit in the second quarter of 2021.”

Sponsored Content from WFG: MBA Reports of Falling Per-Loan Profits Prompt Calls for Greater Efficiencies

On Aug. 30, Mortgage Professional America reported “Independent mortgage banks and mortgage subsidiaries of chartered banks reported hefty declines in their profit in the second quarter of 2021.”

Sponsored Content from WFG: MBA Reports of Falling Per-Loan Profits Prompt Calls for Greater Efficiencies

On Aug. 30, Mortgage Professional America reported “Independent mortgage banks and mortgage subsidiaries of chartered banks reported hefty declines in their profit in the second quarter of 2021.”

Sponsored Content from WFG: MBA Reports of Falling Per-Loan Profits Prompt Calls for Greater Efficiencies

On Aug. 30, Mortgage Professional America reported “Independent mortgage banks and mortgage subsidiaries of chartered banks reported hefty declines in their profit in the second quarter of 2021.”

Sponsored Content from WFG: MBA Reports of Falling Per-Loan Profits Prompt Calls for Greater Efficiencies

On Aug. 30, Mortgage Professional America reported “Independent mortgage banks and mortgage subsidiaries of chartered banks reported hefty declines in their profit in the second quarter of 2021.”

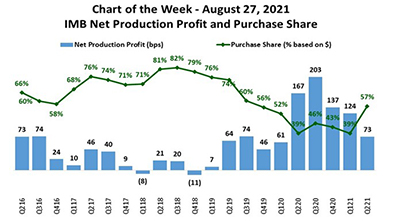

MBA Chart of the Week Aug. 30 2021: IMB Net Production Profit & Purchase Share

In this week’s MBA Chart of the Week, we look at net production profit in basis points, relative to the purchase share of total first mortgage originations by dollar volume over a five-year time span – second quarter 2016 through second quarter 2021.

MBA Chart of the Week Aug. 30 2021: IMB Net Production Profit & Purchase Share

In this week’s MBA Chart of the Week, we look at net production profit in basis points, relative to the purchase share of total first mortgage originations by dollar volume over a five-year time span – second quarter 2016 through second quarter 2021.

MBA: IMB Profits Slow in 2nd Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $2,023 on each loan they originated in the second quarter, down from $3,361 per loan in the first quarter, the Mortgage Bankers Association reported Tuesday in its Quarterly Mortgage Bankers Performance Report.

MBA: IMB Profits Slow in 2nd Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $2,023 on each loan they originated in the second quarter, down from $3,361 per loan in the first quarter, the Mortgage Bankers Association reported Tuesday in its Quarterly Mortgage Bankers Performance Report.