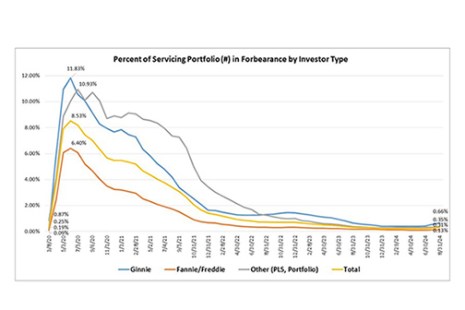

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance decreased by 3 basis points from 0.50% of servicers’ portfolio volume in the prior month to 0.47% as of December 31, 2024.

Tag: Marina Walsh CMB

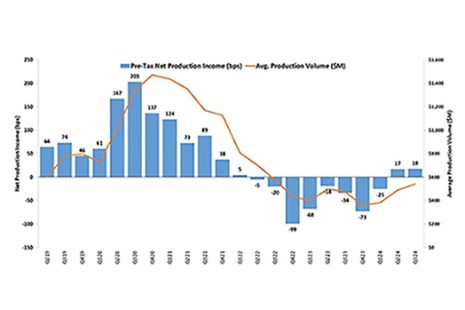

MBA: IMB Production Profits Increase in Third Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net profit of $701 on each loan they originated in the third quarter, an increase from the reported net profit of $693 per loan in the second quarter, according to the Mortgage Bankers Association’s new Quarterly Mortgage Bankers Performance Report.

Share of Mortgage Loans in Forbearance Increases to 0.34% in September

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.34% as of September 30, 2024.

MBA: Share of Mortgage Loans in Forbearance Increases to 0.31% in August

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.31% as of August 31, 2024.

MBA: IMBs Post Net Production Profit for First Time in Two Years

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net profit of $693 on each loan they originated in the second quarter, an increase from the reported loss of $645 per loan in the first quarter, according to the Mortgage Bankers Association’s new Quarterly Mortgage Bankers Performance Report.

Chart of the Week: Annual Cost of Servicing Performing and Non-Performing Loans

Based on the most recent completed study cycle, fully-loaded servicing costs remained flat relative to the previous year at an average of $237 per loan. But that only tells part of the story.

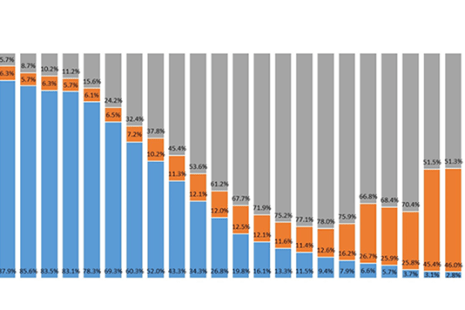

MBA Chart of the Week: Lender’s Loan Expense For Retail, Consumer Direct Channels

The longstanding MBA and STRATMOR Peer Group Roundtables Program recently wrapped up its Spring 2024 season for benchmarking lender performance across various production channels and peer groups.

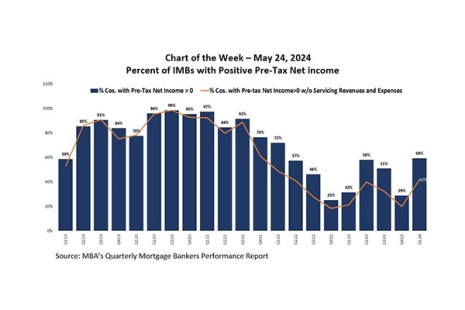

MBA Chart of the Week: Percent of IMBs With Positive Pre-Tax Net Income

According to MBA’s Q1 2024 Quarterly Mortgage Bankers Performance Report, independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net production loss of 25 basis points, or $645 per loan.

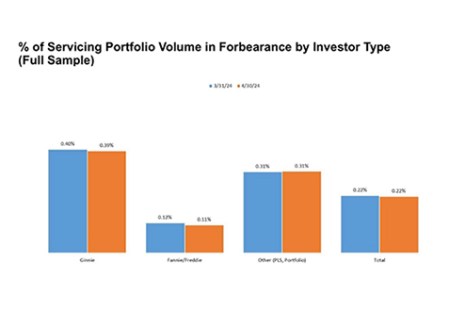

MBA: Share of Mortgage Loans in Forbearance Remains at 0.22% in April

The total number of loans now in forbearance remained unchanged at 0.22% as of April 30, 2024, the Mortgage Bankers Association’s monthly Loan Monitoring Survey reported.

MBA: Mortgage Delinquencies Increase Slightly in First Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.94 percent of all loans outstanding at the end of the first quarter of 2024, according to the Mortgage Bankers Association’s National Delinquency Survey.