MBA: IMB Production Profits Increase in Third Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net profit of $701 on each loan they originated in the third quarter, an increase from the reported net profit of $693 per loan in the second quarter, according to the Mortgage Bankers Association’s new Quarterly Mortgage Bankers Performance Report.

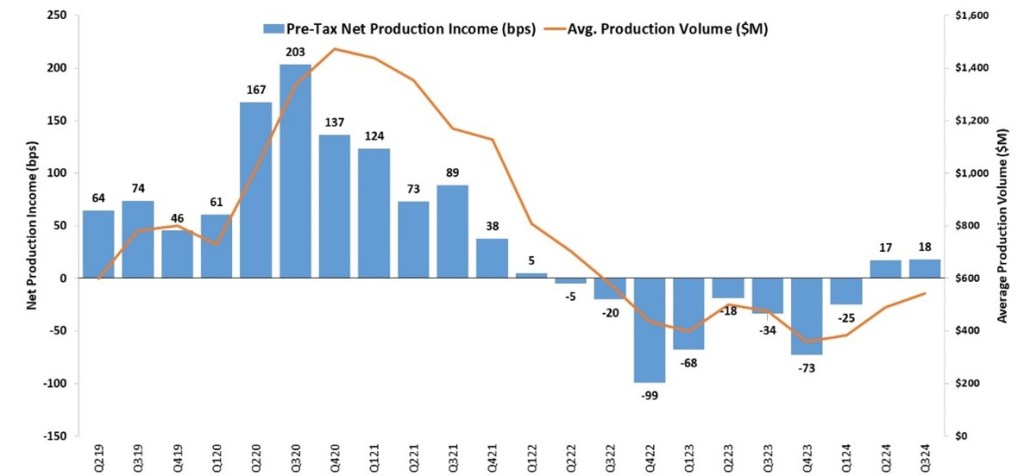

“Mortgage companies reported net production profits for the second consecutive quarter after an unprecedented period of net production losses that spanned two years,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Net production profits increased to 18 basis points last quarter – far improved from the average loss of 43 basis points the past two years – with a drop in secondary marketing income offset by a decrease in production expenses.”

According to Walsh, on the servicing side of the business, the likelihood of higher prepayments in the third quarter resulted in mortgage servicing right (MSR) impairments and less profitability. Net servicing financial income dropped to a loss of $25 per loan serviced in the third quarter, from a gain of $69 per loan observed in the second quarter.

“Overall, it was a decent showing for independent mortgage banks with 71 percent reporting profitability across production and servicing operations, compared to 78 percent in the second quarter,” added Walsh.

Key findings of MBA’s Third-Quarter 2024 Quarterly Mortgage Bankers Performance Report include:

The average pre-tax production profit was 18 basis points (bps) in the third quarter of 2024, up from the reported 17 bps in the second quarter of 2024, and a loss of 34 basis points one year ago. The average quarterly pre-tax production profit, from the third quarter of 2008 to the most recent quarter, is 42 basis points.

The average production volume was $542 million per company in the third quarter, up from $492 million per company in the second quarter. The volume by count per company averaged 1,642 loans in the third quarter, up from 1,503 loans in the second quarter.

Total production revenue (fee income, net secondary marketing income and warehouse spread) decreased to 341 bps in the third quarter, down from 347 bps in the second quarter. On a per-loan basis, production revenues decreased to $11,417 per loan in the third quarter, down from $11,499 per loan in the second quarter.

Total loan production expenses – commissions, compensation, occupancy, equipment, and other production expenses and corporate allocations – decreased to 323 basis points in the third quarter of 2024 from 330 basis points in the second quarter of 2024. Per-loan costs decreased to $10,716 per loan in the third quarter, down from $10,806 per loan in the second quarter of 2024. From the third quarter of 2008 to last quarter, loan production expenses have averaged $7,573 per loan.

The purchase share of total originations, by dollar volume, was 84 percent. For the mortgage industry as a whole, MBA estimates the purchase share was at 75 percent in the third quarter of 2024.

The average loan balance for first mortgages increased to $361,518 in the third quarter, up from $356,993 in the second quarter.

Servicing net financial income for the third quarter (without annualizing) was a loss of $25 per loan, down from $69 per loan in the second quarter. Servicing operating income, which excludes MSR amortization, gains/loss in the valuation of servicing rights net of hedging gains/losses, and gains/losses on the bulk sale of MSRs, was $93 per loan in the third quarter, up from $88 per loan in the second quarter.

Including all business lines (both production and servicing), 71 percent of the firms in the report posted pre-tax net financial profits in the third quarter of 2024, down from 78 percent in the second quarter of 2024.

MBA’s Mortgage Bankers Performance Report series offers a variety of other performance measures on the mortgage banking industry including revenue and cost breakouts, productivity, product mixes for originations and servicing volume, and pull-through rates. MBA’s Mortgage Bankers Performance Report is intended as a financial and operational benchmark for independent mortgage companies, bank subsidiaries and other non-depository institutions. Eighty-two percent of the 345 companies that reported production data for the second quarter of 2024 were independent mortgage companies, and the remaining 18 percent were subsidiaries and other non-depository institutions.

There are five Mortgage Bankers Performance Report publications per year: four quarterly reports and one annual report. Media wishing to view a copy of either report should contact Falen Taylor at (202) 557-2771 or ftaylor@mba.org. To purchase or subscribe to the publications, call (202) 557-2879. The reports can also be purchased on MBA’s website by visiting www.mba.org/PerformanceReport.