Founded in 2008, LBA Ware™, Macon, Ga., is the leading provider of automated incentive compensation management and business intelligence software for mortgage lenders. Our suite of solutions helps mortgage lenders reach new heights with software that integrates data, incentivizes performance and inspires results.

Tag: LBA Ware

MBA Premier Member Profile: LBA Ware

Founded in 2008, LBA Ware™, Macon, Ga., is the leading provider of automated incentive compensation management and business intelligence software for mortgage lenders. Our suite of solutions helps mortgage lenders reach new heights with software that integrates data, incentivizes performance and inspires results.

MBA Premier Member Profile: LBA Ware

Founded in 2008, LBA Ware™, Macon, Ga., is the leading provider of automated incentive compensation management and business intelligence software for mortgage lenders. Our suite of solutions helps mortgage lenders reach new heights with software that integrates data, incentivizes performance and inspires results.

Industry Briefs Nov. 13, 2020

Qualia, San Francisco, launched its Physical Document Service, enabling mortgage lenders to automate management of paper trailing documents from title partners through Qualia.

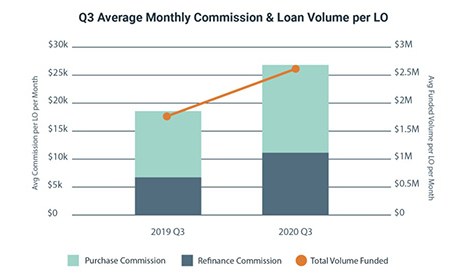

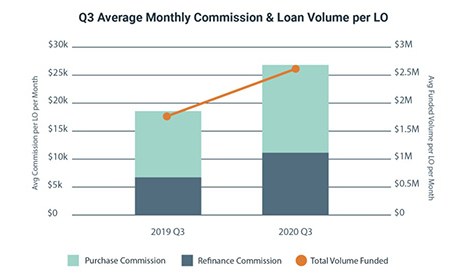

LBA Ware: Heavy Loan Volumes Keeps LO Compensation Elevated

LBA Ware, Macon, Ga., releases its third quarter Mortgage Loan Originator Compensation Reports, showing commissions earned by LOs increased by 50% from a year ago, because the average LO funded 51% more volume in the third quarter ($2.6 million per month) than a year ago ($1.7 million per month).

LBA Ware: Heavy Loan Volumes Keeps LO Compensation Elevated

LBA Ware, Macon, Ga., releases its third quarter Mortgage Loan Originator Compensation Reports, showing commissions earned by LOs increased by 50% from a year ago, because the average LO funded 51% more volume in the third quarter ($2.6 million per month) than a year ago ($1.7 million per month).

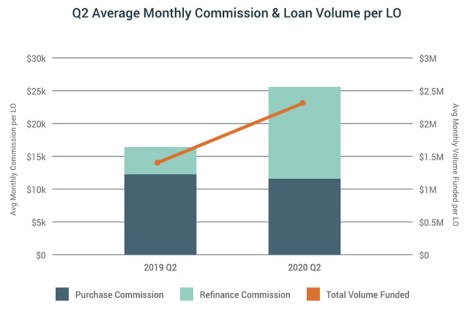

LBA Ware: Surge in Q2 Refinance Volume Nets 59% Increase in LO Commissions

LBA Ware, Macon, Ga., said its quarterly summary of mortgage industry compensation found significant refinance volume growth in the second quarter contributed to a 59% year-over-year increase in total loan originator commissions paid over the three-month period.

Lori Brewer: The Road to Recovery Will be Paved with Data

In a time when everything spells uncertainty, data gives lenders something to hold on to — and a path forward. What performance metrics are most critical for lenders to keep an eye on right now to help their businesses survive the recession and what’s likely to be a protracted recovery?

Lori Brewer: The Road to Recovery Will be Paved with Data

In a time when everything spells uncertainty, data gives lenders something to hold on to — and a path forward. What performance metrics are most critical for lenders to keep an eye on right now to help their businesses survive the recession and what’s likely to be a protracted recovery?

Lori Brewer: The Road to Recovery Will be Paved with Data

In a time when everything spells uncertainty, data gives lenders something to hold on to — and a path forward. What performance metrics are most critical for lenders to keep an eye on right now to help their businesses survive the recession and what’s likely to be a protracted recovery?