LBA Ware: Heavy Loan Volumes Keeps LO Compensation Elevated

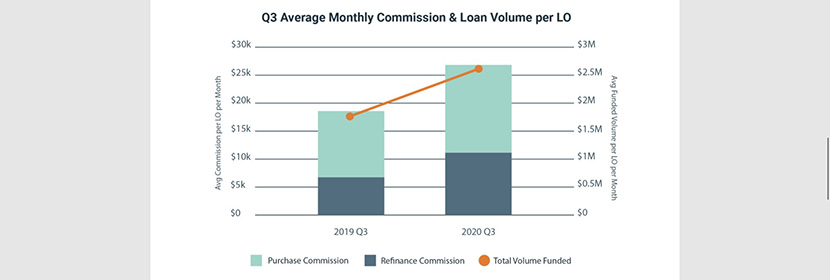

(Chart courtesy LBA Ware.)

LBA Ware, Macon, Ga., releases its third quarter Mortgage Loan Originator Compensation Reports, showing commissions earned by LOs increased by 50% from a year ago, because the average LO funded 51% more volume in the third quarter ($2.6 million per month) than a year ago ($1.7 million per month).

The firm’s analysis of its CompenSafe ICM platform data shows that year-over-year increases in refinance and purchase loan volume contributed to increased commissions for both loan originators (LOs) and loan processors. The controlled, sample dataset consisted of retail, first-lien production from LOs and loan processors with at least six funded loans during the three-month period from July 1-Sept. 30

Other key findings:

–Refinance transactions accounted for 46% of total volume funded in the quarter (compared to just 36% of total volume funded in Q3 2019). LOs averaged $1.2 million in funded refinance volume per month, an increase of more than 75% over Q3 2019.

–Although paychecks were larger in Q3 2020 than Q3 2019, the uptick in refinance production contributed to a 0.9% decrease in per-loan commissions from 107 basis points in Q3 2019 to 106 basis points in Q3 2020. Refinance commissions averaged 100 basis points in Q3 2020 compared to 111 basis points paid out for purchase loans.

–Purchase volume grew year-over-year with LOs averaging $1.45 million in funded purchase loans per month ($1.11 million in Q3 2019) and receiving on average 110.8 basis points per purchase loan (109.8 in Q3 2019).

–Loan processors handled 30% more loans per month in Q3 2020 compared to Q3 2019, fueling a 54% increase in average incentive compensation earned from $5,105 in Q3 2019 to $7,855 per processor in Q3 2020.

“Increased loan volume continues to deliver big paydays for loan originators as well as for loan processors, many of whom earn per-loan unit bonuses,” said LBA Ware Founder and CEO Lori Brewer. “The refi boom won’t continue indefinitely, though, and we’re already seeing some softening in refi volume even as consumer appetite for purchase loans sharpened in Q3.”