Kroll Bond Rating Agency, New York, just released its 2022 Sector Outlook—CMBS: Full Steam Ahead report. MBA NewsLink interviewed KBRA’s Larry Kay and Patrick McQuinn to get their insights on the current lending environment and property fundamentals as well as factors that may affect property performance in 2022.

Tag: Kroll Bond Rating Agency

KBRA Analysts Look to 2022 Commercial Mortgage-Backed Securities Sector

Kroll Bond Rating Agency, New York, just released its 2022 Sector Outlook—CMBS: Full Steam Ahead report. MBA NewsLink interviewed KBRA’s Larry Kay and Patrick McQuinn to get their insights on the current lending environment and property fundamentals as well as factors that may affect property performance in 2022.

KBRA Analysts Look to 2022 Commercial Mortgage-Backed Securities Sector

Kroll Bond Rating Agency, New York, just released its 2022 Sector Outlook—CMBS: Full Steam Ahead report. MBA NewsLink interviewed KBRA’s Larry Kay and Patrick McQuinn to get their insights on the current lending environment and property fundamentals as well as factors that may affect property performance in 2022.

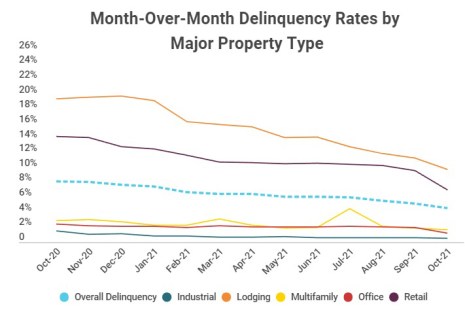

CMBS Delinquency Rate Tumbles

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined sharply again in October.

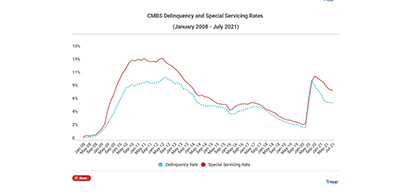

CMBS Delinquency, Special Servicing Rates Dip Again

“More of the same” was the commercial mortgage-backed securities delinquency rate headline in July, according to Trepp Senior Managing Director Manus Clancy.

CMBS Delinquency, Special Servicing Rates Improve

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined again in June–but not by much.

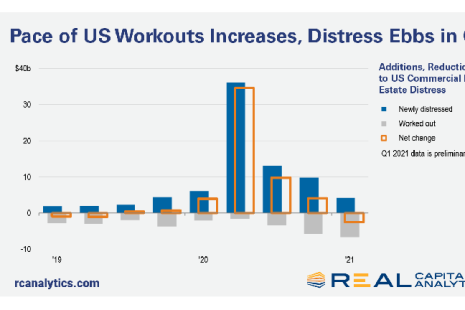

1Q Distressed CRE Debt Drops

More U.S. commercial real estate distress was worked out than arose in the first quarter, reported Real Capital Analytics, New York.

Distressed CRE Debt Drops

More U.S. commercial real estate distress was worked out than arose in the first quarter, reported Real Capital Analytics, New York.

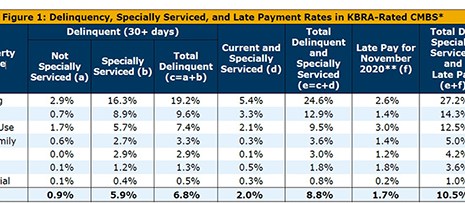

KBRA: Review Those Remittance Reports

Kroll Bond Rating Agency, New York, said higher commercial mortgage-backed securities special servicing volume and modifications increase the risk of operational errors or inconsistencies in servicer and trustee reporting.

CMBS Delinquency Rate Dips

The commercial mortgage-backed securities delinquency rate dipped in November, largely due to continued Coronavirus debt relief, said Fitch Ratings, New York.