KBRA, New York, said the delinquency rate among KBRA-rated U.S. commercial mortgage-backed securities increased 19 basis points in November to 4.4%.

Tag: Kroll Bond Rating Agency

MBA NewsLink Multifamily Roundtable: High Rates, Stalled Rents and New Roofs

As uncertainty dominates discussions about getting deals done, MBA NewsLink convened three multifamily finance executives, Chad Musgrove, John Lloyd and Carl McLaughlin, to get their opinions on where the apartment industry sits and where it’s headed next.

KBRA Finds Challenging Single-Family Rental Fundamentals

Softening operating performance, elevated inflation, labor shortages and decelerating rental rates have produced the most challenging environment for the single-family rental sector yet, reported KBRA, New York.

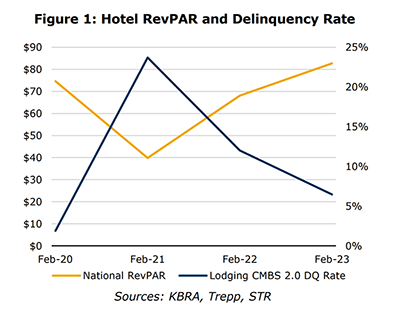

KBRA: Lodging Loan Performance Clouded by Upper-Upscale Chains

U.S. hotels have performed well overall since the pandemic, but upscale properties report higher commercial mortgage-backed securities delinquencies than more modest hotels, reported KBRA, New York.

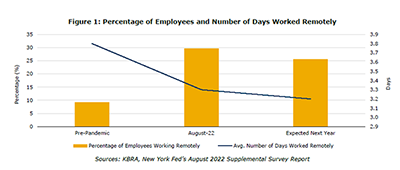

Economic Uncertainty, Remote Work Challenge Office Sector

Despite five interest rate increases in 2022, inflation remains near multi-year highs. This could hit the office sector harder than other property types, said KBRA, New York.

A Decade in the Making: KBRA on SFR Trends and Outlook

KBRA, New York, recently published a report, SFR Securitizations: A Decade in the Making, analyzing the sector’s evolution and growth. MBA Newslink interviewed the report’s authors about the factors driving the sector’s growth.

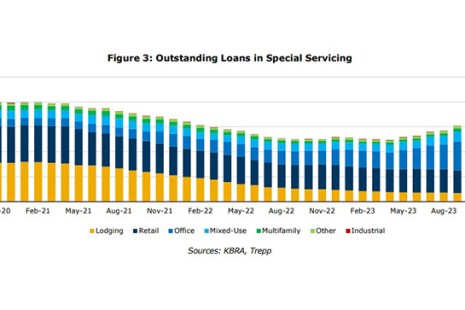

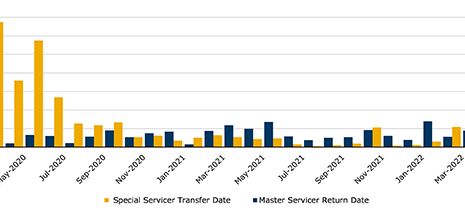

KBRA: Servicers Performed Admirably During COVID

Kroll Bond Rating Agency, New York, said commercial mortgage-backed securities servicers “performed admirably” over the last two years while facing nearly unprecedented distress during the COVID pandemic.

Fitch: Slowing Trend in CMBS Defeasance

Commercial mortgage-backed securities defeasance volume soared during late 2021 and into January, but that trend could be ending, said Fitch Ratings, New York.

CMBS Defeasance Snaps Back

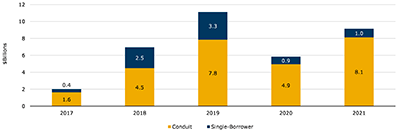

Kroll Bond Rating Agency, New York, reported commercial mortgage-backed securities defeasance volume rebounded strongly last year after falling by nearly half in 2020.

CMBS Delinquency, Special Servicing Rates Dip in December

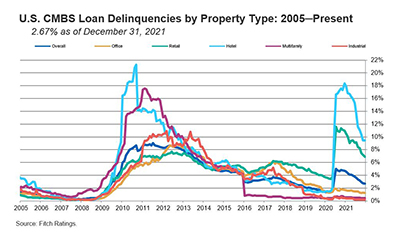

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate dipped nine basis points in December to 2.67 percent, driven by robust new issuance, continued loan resolutions and fewer new delinquencies.