This week’s Chart of the Week details turn times for the broker wholesale and non-delegated correspondent production channels in the first quarter of 2025.

Tag: Jon Penniman

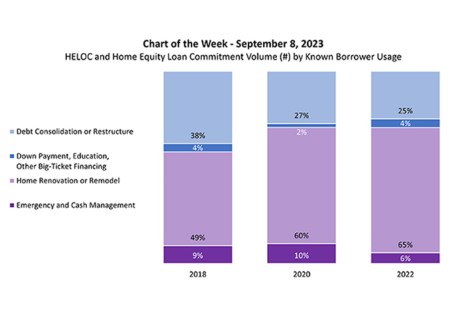

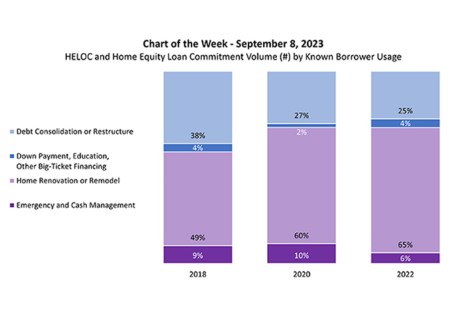

MBA Chart of the Week: HELOC and Home Equity Loan Commitment Volume

This week’s MBA Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan.

MBA Chart of the Week: HELOC and Home Equity Loan Commitment Volume

This week’s MBA Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan.

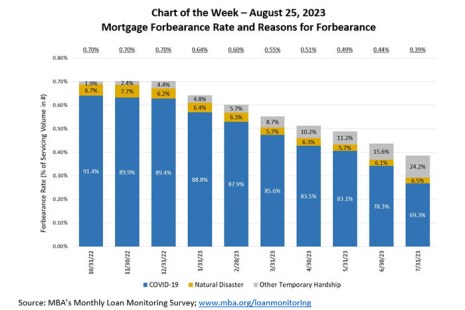

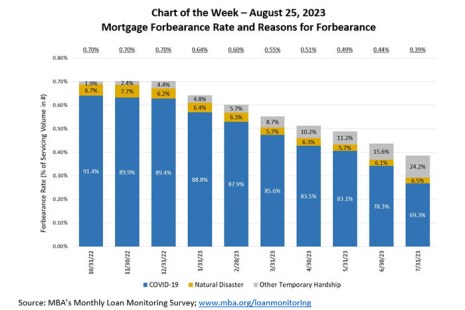

MBA Chart of the Week Aug. 28: Mortgage Forbearance Rate and Reasons for Forbearance

According to the July results from MBA’s Monthly Loan Monitoring Survey, the total number of loans now in forbearance decreased by 5 basis points from 0.44% of servicers’ portfolio volume in the prior month to 0.39% as of July 31, 2023.

MBA Chart of the Week Aug. 28: Mortgage Forbearance Rate and Reasons for Forbearance

According to the July results from MBA’s Monthly Loan Monitoring Survey, the total number of loans now in forbearance decreased by 5 basis points from 0.44% of servicers’ portfolio volume in the prior month to 0.39% as of July 31, 2023.

MBA Chart of the Week July 31: Analyzing HMDA Data

A total of 4,290 companies reported lending activity under the Home Mortgage Disclosure Act (HMDA) in 2022, according to MBA’s analyses of the dataset.

MBA Chart of the Week July 31: Analyzing HMDA Data

A total of 4,290 companies reported lending activity under the Home Mortgage Disclosure Act (HMDA) in 2022, according to MBA’s analyses of the dataset.

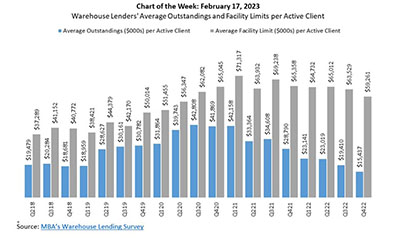

MBA Chart of the Week Feb. 17, 2023: Warehouse Lending

According to MBA’s latest Warehouse Lending Survey, warehouse lenders – as of the end of fourth-quarter 2022 – reported an average outstanding balance of $15.4 million per active client on their warehouse lines for first mortgages held for sale. This marks the fifth consecutive quarterly decline in per-client outstandings

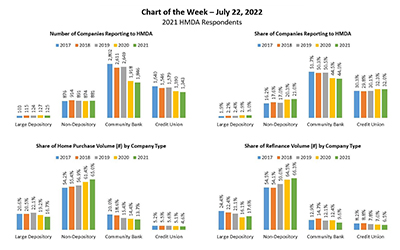

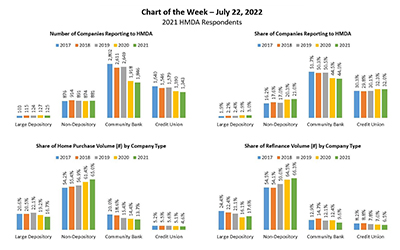

MBA Chart of the Week: 2021 HMDA Respondents

A total of 4,195 companies reported lending activity under the Home Mortgage Disclosure Act in 2021, according to MBA’s own analyses of the dataset. Company types are defined by primary regulator and balance sheet assets, with large depositories holding assets of $10 billion or more.

MBA Chart of the Week: 2021 HMDA Respondents

A total of 4,195 companies reported lending activity under the Home Mortgage Disclosure Act in 2021, according to MBA’s own analyses of the dataset. Company types are defined by primary regulator and balance sheet assets, with large depositories holding assets of $10 billion or more.