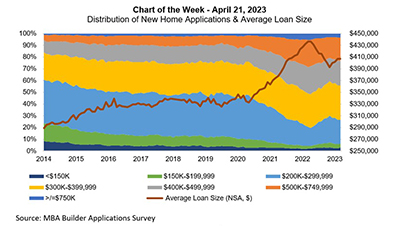

This week’s MBA Chart of the Week delves into builder applications by loan size, to illustrate how the mix of the new home market has changed since 2014.

Tag: Joel Kan

MBA Chart of the Week Apr. 21, 2023–New Home Applications, Average Loan Size

This week’s MBA Chart of the Week delves into builder applications by loan size, to illustrate how the mix of the new home market has changed since 2014.

MBA Weekly Survey Apr. 19, 2023: Rising Rates Dampen Applications

Mortgage applications fell for the second time in three weeks as rising interest rates curtailed activity, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending April 14.

MBA Weekly Survey Apr. 19, 2023: Rising Rates Dampen Applications

Mortgage applications fell for the second time in three weeks as rising interest rates curtailed activity, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending April 14.

March New Home Purchase Mortgage Applications Up 10%

The Mortgage Bankers Association said mortgage applications for new home purchases in March increased by 10 percent from February and by 0.6 percent from a year ago.

March New Home Purchase Mortgage Applications Up 10%

The Mortgage Bankers Association said mortgage applications for new home purchases in March increased by 10 percent from February and by 0.6 percent from a year ago.

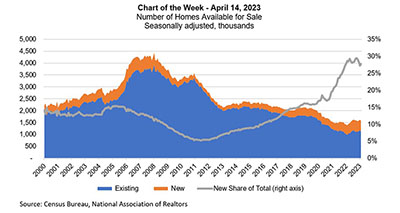

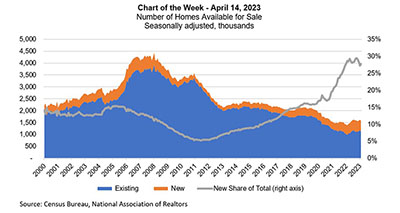

MBA Chart of the Week, Apr. 14, 2023: Number of Homes Available for Sale

MBA’s forecast calls for a gradual recovery in home purchase activity in the second half of 2023, driven by some catch-up buying from 2022 when mortgage rates surged and by younger age cohorts entering homeownership. However, this recovery will be dependent on affordability conditions improving

MBA Chart of the Week, Apr. 14, 2023: Number of Homes Available for Sale

MBA’s forecast calls for a gradual recovery in home purchase activity in the second half of 2023, driven by some catch-up buying from 2022 when mortgage rates surged and by younger age cohorts entering homeownership. However, this recovery will be dependent on affordability conditions improving

MBA Weekly Applications Survey Apr. 12: Applications Increase

Mortgage applications increased 5.3 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending April 7, 2023.

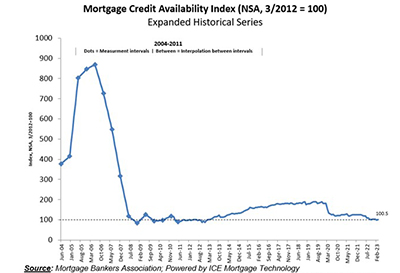

March Mortgage Credit Availability Posts Modest Increase

Mortgage credit availability rose in March after falling to a 10-year-low in February, the Mortgage Bankers Association reported Tuesday.