MBA Chart of the Week Dec. 16, 2022: Federal Funds Rate Projections

In an effort to increase transparency after the Great Recession, one of the Federal Open Market Committee communication initiatives under Chairman Ben Bernanke was to publish individual members’ assessments of the economy in the Summary of Economic Projections. The SEP also includes each participant’s projection, based on information available at the time of the FOMC meeting and their assessment of “appropriate monetary policy,” of a path for the federal funds rate.

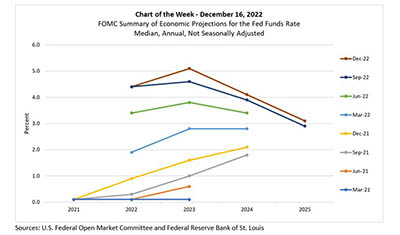

In this week’s MBA Chart of the Week, we track changes in policymakers’ quarterly published SEP forecasts of the federal funds rate over the last eight quarters. Each line represents, for a given vintage of predictions, the median value of the projected appropriate target level for the federal funds rate at the end of the specified calendar year. For example, the brown line, that depicts the December 2022 SEP projections published on Wednesday, shows a median target level at the end of 2023 of 5.125%. The chart also illustrates how policymakers’ views have evolved over time – in the September 2022 SEP the comparative end of 2023 rate was 4.625% (navy line), and in December 2021 it was 1.625% (yellow line). As the FOMC has focused on curbing inflation, which reached a 40-year high of 9.1% year-over-year growth in June 2022, the Committee’s projected end of year rates for 2022 through 2025 have shifted upward with each quarter’s new projections.

Importantly for the mortgage market, in this week’s release, the FOMC also signaled that they anticipate slower growth, higher unemployment, and higher inflation in 2023 than they had indicated at the September meeting. If recent trends continue with respect to consistent deceleration in inflation amidst an increasing risk of recession, we may be near the peak rate for this cycle.

MBA is forecasting a recession for the first half of 2023, as the full impact of these rate hikes is absorbed throughout the economy. As such, we are forecasting that the federal funds rate will not exceed 5% in 2023. Furthermore, weaker growth typically leads to lower long-term interest rates, including mortgage rates. We are thus forecasting that mortgage rates for 30-year fixed-rate loans, which were at 6.4% last week, are expected to drift down and end 2023 around 5.2%.

–Mike Fratantoni mfratantoni@mba.org; Joel Kan jkan@mba.org; Edward Seiler eseiler@mba.org.