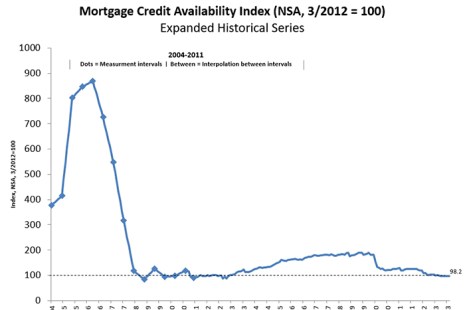

Mortgage credit availability increased in October according to the Mortgage Credit Availability Index, a report from the Mortgage Bankers Association that analyzes data from ICE Mortgage Technology.

Tag: Joel Kan

MBA Weekly Survey Nov. 8: Mortgage Applications Increase

Mortgage applications increased 2.5 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending November 3, 2023.

Quote: Nov. 8, 2023

“MBA is disappointed that the report fails to engage in a more meaningful examination of the potential benefits of diversifying the FHLB system through the expansion of membership to other critical providers of mortgage origination, servicing, and investment activities,” –Pete Mills, Senior Vice President of Residential Policy and Strategic Industry Engagement at MBA

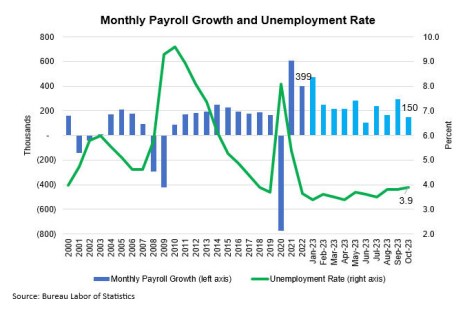

MBA Chart of the Week: Monthly Payroll Growth and Unemployment Rate

This week’s Chart of the Week highlights the October Employment Situation results released Friday.

MBA Weekly Survey Nov. 1: Mortgage Applications Decrease

Mortgage applications decreased 2.1 percent from one week earlier, according the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending October 27, 2023.

MBA Weekly Survey Nov. 1: Mortgage Applications Decrease

Mortgage applications decreased 2.1 percent from one week earlier, according the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending October 27, 2023.

MBA Weekly Survey Oct. 25: Applications Decrease Again

Mortgage applications decreased 1.0 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending October 20, 2023.

MBA Weekly Survey Oct. 25: Applications Decrease Again

Mortgage applications decreased 1.0 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending October 20, 2023.

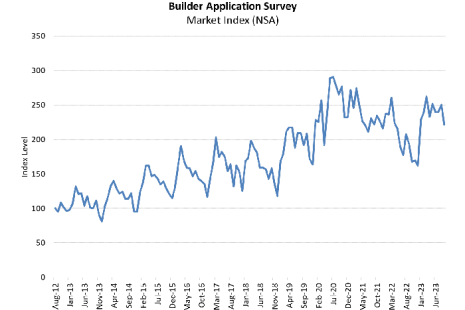

MBA: September New Home Purchase Mortgage Applications Increased 14.9%

The Mortgage Bankers Association Builder Application Survey data for September 2023 shows mortgage applications for new home purchases increased 14.9 percent from a year ago.

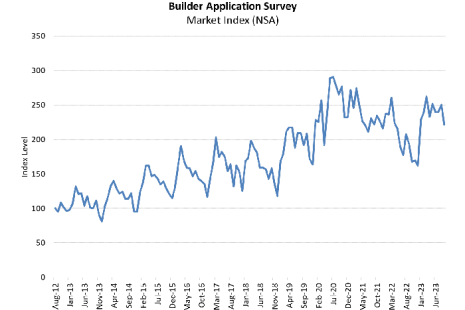

MBA: September New Home Purchase Mortgage Applications Increased 14.9%

The Mortgage Bankers Association Builder Application Survey data for September 2023 shows mortgage applications for new home purchases increased 14.9 percent from a year ago.