New Home Sales Dip From September

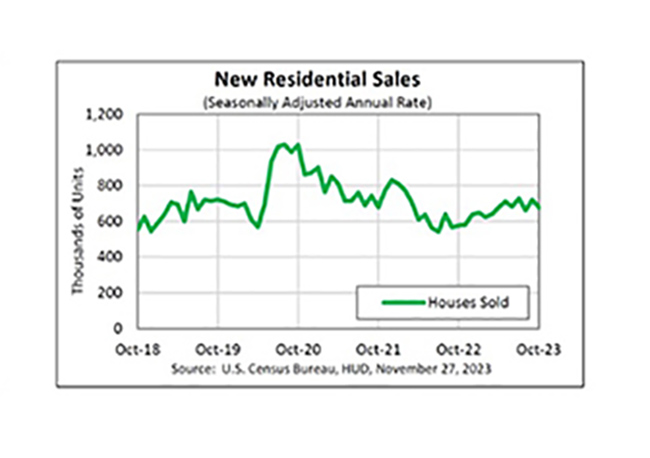

(Chart courtesy of U.S. Census Bureau)

New single‐family home sales fell 5.6% in October to a seasonally adjusted annual rate of 679,000, the Census Bureau reported Monday.

But new home sales were 17.7% above October 2022’s 577,000 pace, Census said.

The supply of new houses for sale increased from 7.2 in September to 7.8 months at the end of October.

First American Economist Ksenia Potapov noted builders are “leaning into” incentives. “Historically, the median sale price of a new home has been higher than that of an existing home, but that spread has steadily declined this year as the ‘rare and elusive’ existing home for sale just keeps getting more expensive,” she said. “A new home provides a good alternative.”

The Mortgage Bankers Association recently released its Builder Application Survey data for October 2023. It found that mortgage applications for new home purchases increased 39.7% compared from a year ago. Compared to September 2023, applications increased by 6%. This change does not include any adjustment for typical seasonal patterns.

“Purchase activity for newly constructed homes continued its upward climb in October with purchase applications up 40% compared to a year ago, the ninth consecutive month of annual growth,” said Joel Kan, MBA vice president and deputy chief economist. “Home builders have been able to temper this high-rate environment by offering buyers rate buydowns and other incentives. We estimate that the pace of home sales increased for the third straight month to a 715,000-unit annual pace – the strongest sales month since May 2023.”

Potapov noted entry-level supply remains especially limited, even as millennials continue to age into their prime home-buying years. “This month, 15% of new-home sales were priced below $300,000, up from 13% one year ago,” she said. “The housing market remains underbuilt relative to demand, so the lesson seems to be that if you build it – and perhaps buy down the rate – buyers will buy it.”

Fannie Mae Chief Economist Doug Duncan said he expects new home sales to soften over the remainder of the year, “but with mortgage rates recently pulling back somewhat, we don’t expect the decline to be large,” he said. “We believe the ongoing lack of existing homes available for sale will continue to support demand for new homes.”