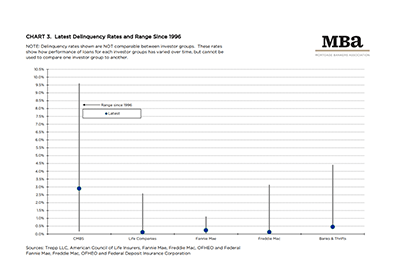

Commercial and multifamily mortgage delinquencies remained low in the fourth quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report.

Tag: Jamie Woodwell

MBA: 4Q Commercial, Multifamily Mortgage Delinquency Rate Remains Low

Commercial and multifamily mortgage delinquencies remained low in the fourth quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report.

#MBACREF23: 2023 Commercial/Multifamily Borrowing, Lending Expected to Fall to $684B

SAN DIEGO – The Mortgage Bankers Association said total commercial and multifamily mortgage borrowing and lending is expected to fall to $684 billion this year, a 15 percent decline from an expected 2022 total of $804 billion.

#MBACREF23: 2023 Commercial/Multifamily Mortgage Maturity Volumes Up 33 Percent

SAN DIEGO – The Mortgage Bankers Association said $331.2 billion of the $2.8 trillion (12 percent) of outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2023, a 33 percent increase from the $249 billion that matured in 2022.

#MBACREF23: 4Q Commercial/Multifamily Borrowing Down 54%

SAN DIEGO–Commercial and multifamily mortgage loan originations were 54 percent lower in the fourth quarter from a year ago and decreased by 23 percent from the third quarter, the Mortgage Bankers Association reported Monday.

#MBACREF23: 2023 Commercial/Multifamily Mortgage Maturity Volumes Up 33 Percent

SAN DIEGO – The Mortgage Bankers Association said $331.2 billion of the $2.8 trillion (12 percent) of outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2023, a 33 percent increase from the $249 billion that matured in 2022.

#MBACREF23: 2023 Commercial/Multifamily Borrowing, Lending Expected to Fall to $684B

SAN DIEGO – The Mortgage Bankers Association said total commercial and multifamily mortgage borrowing and lending is expected to fall to $684 billion this year, a 15 percent decline from an expected 2022 total of $804 billion.

#MBACREF23: 4Q Commercial/Multifamily Borrowing Down 54%

SAN DIEGO–Commercial and multifamily mortgage loan originations were 54 percent lower in the fourth quarter from a year ago and decreased by 23 percent from the third quarter, the Mortgage Bankers Association reported Monday.

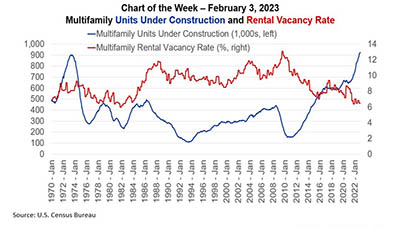

MBA Chart of the Week Feb. 3, 2023: Multifamily Construction/Vacancies

At the end of this week, many of us will begin our annual migration to San Diego and to MBA’s Commercial/Multifamily Finance Convention & Expo (CREF23). There will be no lack of topics to discuss – from return to the office, to the return of retail, and interest in cap rates to interest rate caps.

MBA Chart of the Week Feb. 3, 2023: Multifamily Construction/Vacancies

At the end of this week, many of us will begin our annual migration to San Diego and to MBA’s Commercial/Multifamily Finance Convention & Expo (CREF23). There will be no lack of topics to discuss – from return to the office, to the return of retail, and interest in cap rates to interest rate caps.