#MBACREF23: 4Q Commercial/Multifamily Borrowing Down 54%

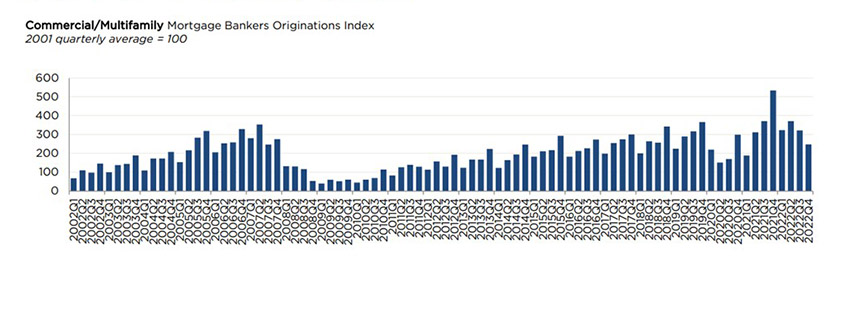

SAN DIEGO–Commercial and multifamily mortgage loan originations were 54 percent lower in the fourth quarter from a year ago and decreased by 23 percent from the third quarter, the Mortgage Bankers Association reported Monday.

The Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations, released here Monday at the MBA 2023 Commercial/Multifamily Finance Convention and Expo, also reported decreases in originations for industrial, office, multifamily, and retail, properties led the overall drop in commercial/multifamily lending volumes.

”Borrowing and lending backed by commercial and multifamily properties slipped further to close out 2022,” said Jamie Woodwell, MBA Head of Commercial Real Estate Research. “The last quarter of the year typically sees the highest volumes, but the chill caused by rising interest rates, questions about property valuations and increased economic uncertainty made the fourth quarter of 2022 the weakest of the year.”

Woodwell noted depositories were the one major capital source to increase volumes from the previous year, “but even its fourth quarter activity was roughly half of what it was a year earlier. The overall picture is one of slower borrowing in the face of what have been significant shifts in the market.”

MBA, as more data comes in, will update and release final 2022 volumes over the next month.

Originations Down 54% in 4th Quarter

Decreases in originations for industrial, office, multifamily and retail properties led the overall drop in commercial/multifamily lending volumes from a year ago. MBA reported a 69 percent year-over-year decrease in the dollar volume of loans for industrial properties, a 56 percent decrease for office properties, a 52 percent decrease for multifamily properties, a 46 percent decrease for hotel properties and a 44 percent decrease for retail properties. Health care property loan originations increased by 4 percent from a year ago.

Among investor types, dollar volume of loans originated for commercial mortgage-backed securities decreased by 92 percent year-over-year. MBA reported a 60 percent decrease for investor-driven lenders, a 53 percent decrease in life insurance company loans, a 47 percent decrease for depositories and a 13 percent decrease in the dollar volume of government-sponsored enterprises (Fannie Mae and Freddie Mac) loans.

4Q Originations Down 23% from 3Q

On a quarterly basis, fourth-quarter originations for hotel properties fell by 39 percent. MBA reported a 38 percent decrease in originations for industrial properties, a 37 percent decrease for retail properties and a 34 percent decrease for health care properties. Originations for multifamily decreased by 23 percent, while originations for office properties increased by 9 percent.

Among investor types, dollar volume of loans for investor-driven lenders decreased by 38 percent, loans for CMBS decreased by 35 percent, originations for depositories decreased by 33 percent and loans for life insurance companies decreased by 5 percent. Dollar volume of loans for GSEs increased by 4 percent.

Preliminary 2022 Originations 10% Lower than 2021

A preliminary measure of commercial and multifamily mortgage bankers’ originations volumes shows activity in 2022 was 10 percent lower than in 2021. By property type, mortgage bankers originations for office properties decreased by 30 percent, industrial properties decreased by 12 percent and multifamily properties decreased by 11 percent. Retail properties increased by 16 percent, hotel properties increased by 16 percent and health care property originations increased by 23 percent.

Among investor types for 2022, mortgage bankers originations for CMBS decreased by 63 percent, originations for life insurance companies decreased by 19 percent, loans for investor-driven lenders decreased by 9 percent and loans for GSEs decreased by 4 percent. Depository loans increased by 22 percent.

To view the report, click here.