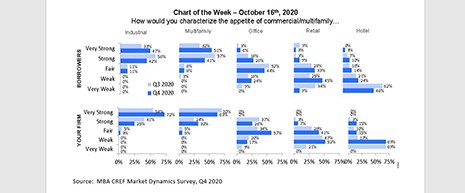

CRE mortgage demand is generally on the rise, with four times more firms expecting borrower demand to be “very strong” in the fourth quarter (24%), compared to the 6% who believed demand was “very strong” in the third quarter.

Tag: Jamie Woodwell

MBA Chart of the Week: Appetite for Commercial/Multifamily

CRE mortgage demand is generally on the rise, with four times more firms expecting borrower demand to be “very strong” in the fourth quarter (24%), compared to the 6% who believed demand was “very strong” in the third quarter.

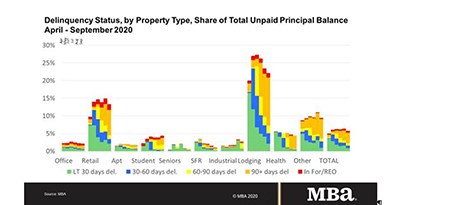

MBA: September Commercial, Multifamily Mortgage Delinquencies Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties declined in September, the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey reported.

MBA: September Commercial, Multifamily Mortgage Delinquencies Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties declined in September, the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey reported.

MBA: Commercial, Multifamily Mortgage Delinquencies Decrease in September

Delinquency rates for mortgages backed by commercial and multifamily properties declined in September, the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey reported.

MBA: 2Q Commercial/Multifamily Mortgage Debt Rises

The Mortgage Bankers Association’s latest quarterly Commercial/Multifamily Mortgage Debt Outstanding report found commercial and multifamily mortgage debt outstanding rose by $43.6 billion (1.2 percent) in the second quarter.

MBA: 2Q Commercial/Multifamily Mortgage Debt Rises

The Mortgage Bankers Association’s latest quarterly Commercial/Multifamily Mortgage Debt Outstanding report found commercial and multifamily mortgage debt outstanding rose by $43.6 billion (1.2 percent) in the second quarter.

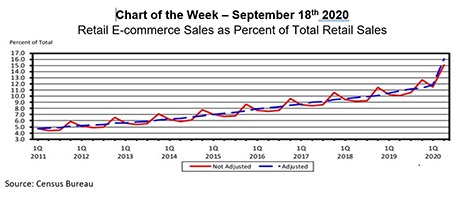

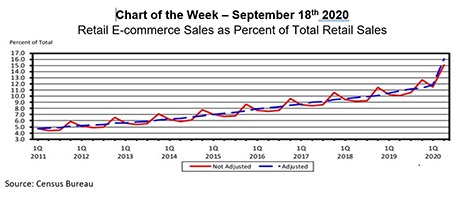

MBA Chart of the Week: Retail E-Commerce/Retail Sales

Even before the onset of the pandemic, retail properties were under the microscope. Practitioners spoke about the United States being “over-retailed” compared to other countries, about a shift to experiential retail with a focus on services rather than goods, and about how the rise in e-commerce is a challenge to bricks-and-mortar.

MBA Chart of the Week: Retail E-Commerce/Retail Sales

Even before the onset of the pandemic, retail properties were under the microscope. Practitioners spoke about the United States being “over-retailed” compared to other countries, about a shift to experiential retail with a focus on services rather than goods, and about how the rise in e-commerce is a challenge to bricks-and-mortar.

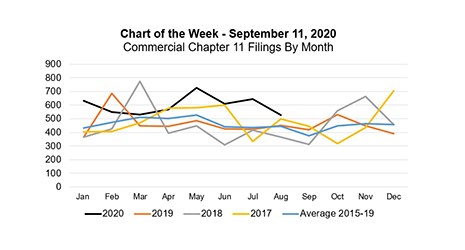

MBA Chart of the Week: Commercial Chapter 11 Filings By Month

As the U.S. economy works its way through the current pandemic and recession, housing has been a clear bright spot in an otherwise dire time. This week’s chart highlights the “V” shaped recovery exhibited by various measures of housing health.