Commercial, Multifamily Mortgage Delinquencies Decline in October

Delinquency rates for mortgages backed by commercial and multifamily properties declined in October, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

“Commercial and multifamily mortgage performance improved in October, but there continues to be evidence of elevated stress, especially among loans backed by retail and lodging properties,” said MBA Vice President of Commercial Real Estate Research Jamie Woodwell. “The share of loans becoming newly delinquent fell again in October, but a larger share of non-current loans shifted to later-stage delinquencies. In essence, fewer loans are becoming delinquent, but those that are delinquent show fewer signs of curing.”

Woodwell noted MBA developed the survey to better understand the ways the pandemic is and is not impacting commercial mortgage loan performance.

Key Findings from MBA’s CREF Loan Performance Survey for September 2020:

Commercial and multifamily mortgage loan performance improved for the second straight month in October, driven by fewer new loans becoming delinquent.

- 94.6% of outstanding loan balances were current, up from 94.3% in September.

- 3.4% were 90+ days delinquent or in REO, down from 3.5% a month earlier.

- 0.6% were 60-90 days delinquent (unchanged from September).

- 0.6% were 30-60 days delinquent, down from 0.7%.

- 0.7% were less than 30 days delinquent, down from 0.9%.

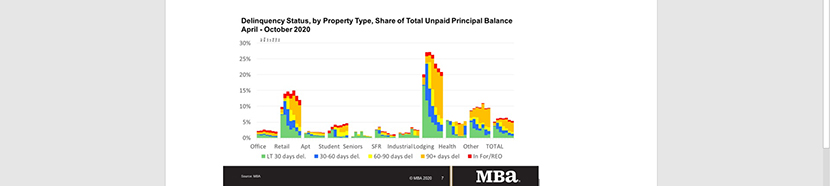

Loans backed by lodging and retail properties continue to see the greatest stress, with a higher share of non-current loan balances entering late-stage delinquency. The overall share of lodging and retail loan balances that are delinquent fell again in October.

- 21.0% of the balance of lodging loans and 12.0% of the balance of retail loans were non-current in October, down from 22.1% and 13.3%, respectively, in September.

- Non-current rates for other property types were more moderate – and generally falling.

- 2.6% of the balances of industrial property loans were non-current, down from 2.7% in September.

- 2.0% of the balances of office property loans were non-current, down from 2.1%.

- 1.6% of multifamily balances were non-current, down from 1.7%.

Because of the concentration of hotel and retail loans, CMBS loan delinquency rates are higher than other capital sources, but they also declined for the second straight month.

- 9.9% of CMBS loan balances were non-current in October, down from 10.9% in September.

- Non-current rates for other capital sources were more moderate – and generally falling.

- 2.4% of FHA multifamily and health care loan balances were non-current, down from 2.6% in September.

- 1.8% of life company loan balances were non-current, down from 1.9% in September.

- 1.3% of GSE loan balances were non-current – flat from September.

MBA’s CREF Loan Performance survey collected information on commercial and multifamily mortgage portfolios as of October 20, 2020. This month’s results build on similar monthly surveys conducted since April. Participants reported on $1.8 trillion of loans in October, representing approximately half of the total $3.7 trillion in commercial and multifamily mortgage debt outstanding. Click here for more information on MBA’s CREF Loan Performance Survey for October 2020.