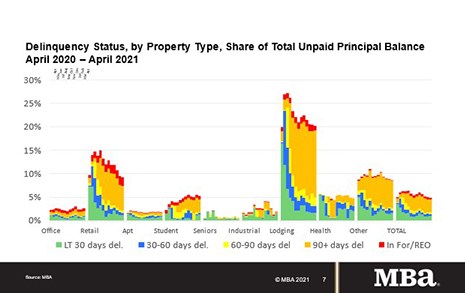

Delinquency rates for mortgages backed by commercial and multifamily properties decreased again in April, reaching the lowest level since the onset of the COVID-19 pandemic, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

Tag: Jamie Woodwell

MBA: April Commercial/Multifamily Mortgage Delinquencies Decline

Delinquency rates for mortgages backed by commercial and multifamily properties decreased again in April, reaching the lowest level since the onset of the COVID-19 pandemic, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

Quote

“Commercial and multifamily mortgage delinquency rates declined in April but remain elevated overall, driven by the continuing challenges facing many hotel and retail properties”–MBA Vice President of Commercial Real Estate Research Jamie Woodwell.

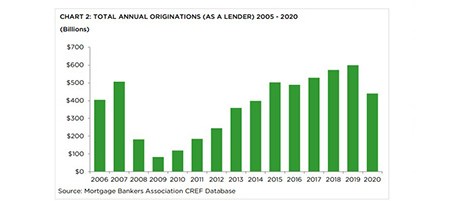

MBA: 2020 Commercial, Multifamily Mortgage Bankers Originations Fall to $441.5 Billion

Commercial and multifamily mortgage bankers closed $441.5 billion in loans in 2020, the Mortgage Bankers Association’s 2020 Commercial Real Estate/Multifamily Finance Annual Origination Volume Summation reported, nearly 26 percent lower than the record $601 billion reported in 2019.

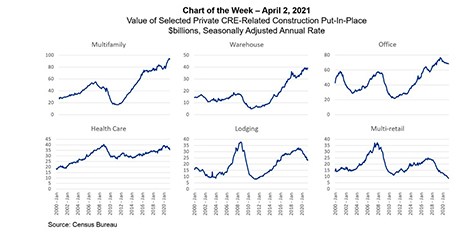

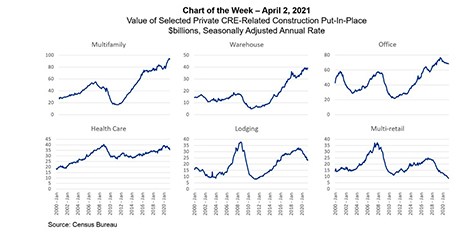

MBA Chart of the Week Apr. 5, 2021: Value of CRE Construction

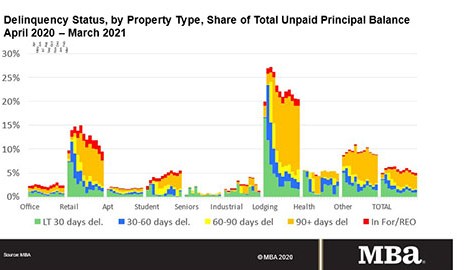

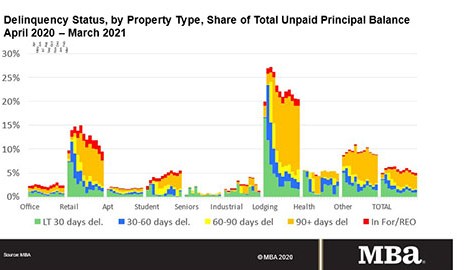

One of the most striking aspects of the COVID-19 pandemic’s impact on commercial and multifamily real estate has been the disparity in the ways different property types have been affected. MBA’s monthly CREF Loan Performance Survey continues to show the immediate and dramatic rise in delinquency rates among lodging and retail properties.

MBA Chart of the Week Apr. 5, 2021: Value of CRE Construction

One of the most striking aspects of the COVID-19 pandemic’s impact on commercial and multifamily real estate has been the disparity in the ways different property types have been affected. MBA’s monthly CREF Loan Performance Survey continues to show the immediate and dramatic rise in delinquency rates among lodging and retail properties.

MBA: March Commercial/Multifamily Mortgage Delinquencies Fall for 3rd Straight Month

Delinquency rates for mortgages backed by commercial and multifamily properties decreased again in March, reaching the lowest level since the onset of the COVID-19 pandemic, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.

MBA: March Commercial/Multifamily Mortgage Delinquencies Fall for 3rd Straight Month

Delinquency rates for mortgages backed by commercial and multifamily properties decreased again in March, reaching the lowest level since the onset of the COVID-19 pandemic, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.

JLL, CBRE, KeyBank Lead MBA 2020 Commercial/Multifamily Originators

The Mortgage Bankers Association this week released its 2020 Rankings of Commercial/Multifamily Mortgage Firms by origination volumes. The report said JLL, CBRE and KeyBank led commercial/multifamily overall rankings.

MBA: Commercial/Multifamily Mortgage Debt Up 5.8 Percent in Fourth Quarter

Commercial/multifamily mortgage debt outstanding at the end of 2020 rose by $212 billion (5.8 percent) from the previous year, the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report said.