MBA: February Commercial, Multifamily Mortgage Delinquency Rates Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties decreased in February, as the COVID-19 pandemic’s impact on commercial and multifamily mortgage performance continues to vary by the different types of commercial real estate, the Mortgage Bankers Association reported.

MBA released two reports today, the February Commercial Real Estate Finance Loan Performance Survey and the latest quarterly Commercial/Multifamily Delinquency Report for the fourth quarter.

The CREF Loan Performance Survey was developed to better understand the ways the pandemic is impacting commercial mortgage loan performance. MBA’s regular quarterly analysis of commercial/multifamily delinquency rates is based on third-party numbers covering each of the major capital sources.

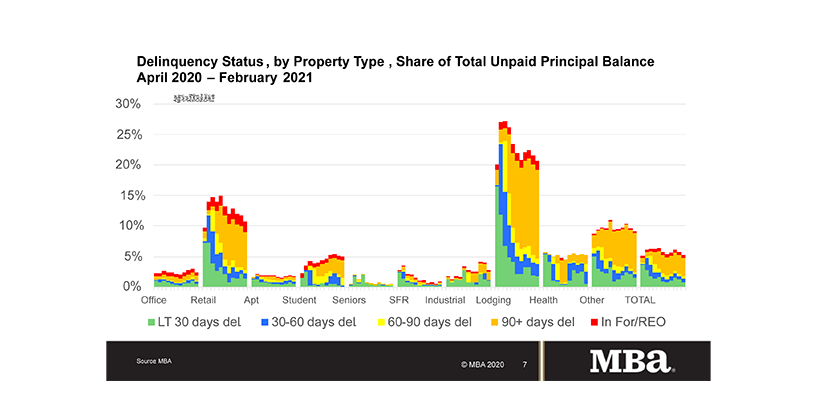

“After slight deterioration at the end of 2020, commercial and multifamily mortgage performance improved for the second straight month in February, bringing delinquency rates down to the lowest level since April 2020,” said MBA Vice President of Commercial Real Estate Research Jamie Woodwell. “Lodging and retail property loans continue to show the greatest stress, but the shares of outstanding loan balances that are delinquent have fallen from their peak levels by 25 percent and 28 percent, respectively.”

Woodwell noted across all property types, the share of outstanding balances becoming newly delinquent is also the lowest since the onset of the pandemic, and less than one-quarter the level from April 2020.

Key Findings from MBA’s CREF Loan Performance Survey for February:

The balance of commercial and multifamily mortgages that are not current decreased in February to its lowest level since April 2020.

- 94.8% of outstanding loan balances were current, up from 94.3% in January.

- 3.5% were 90+ days delinquent or in REO, down from 3.6% a month earlier.

- 0.3% were 60-90 days delinquent, unchanged from a month earlier.

- 0.6% were 30-60 days delinquent, unchanged from a month earlier.

- 0.8% were less than 30 days delinquent, down from 1.2%.

Loans backed by lodging and retail properties continue to see the greatest stress. The overall share of lodging, retail, industrial and office loan balances that are delinquent decreased in February.

- 20.6% of the balance of lodging loans were not current in January, down from 21.5% a month earlier.

- 10.8% of the balance of retail loan balances were delinquent, down from 11.8% a month earlier.

- Non-current rates for other property types were lower during the month.

- 2.7% of the balances of industrial property loans were non-current, down from 4.0% a month earlier.

- 2.4% of the balances of office property loans were non-current, down from 3.0% a month earlier.

- 1.7% of multifamily balances were non-current, up from 1.8% a month earlier.

Because of the concentration of hotel and retail loans, CMBS loan delinquency rates are higher than other capital sources.

- 9.3% of CMBS loan balances were non-current, down from 10.0% a month earlier.

- Non-current rates for other capital sources were more moderate.

- 2.7% of FHA multifamily and health care loan balances were non-current, down from 3.2% a month earlier.

- 2.0% of life company loan balances were non-current, down from 2.1%.

- 1.3% of GSE loan balances were non-current, up from 1.2% a month earlier.

For more information on MBA’s CREF Loan Performance Survey for February, click here.

Key Findings from MBA’s Fourth Quarter Commercial/Multifamily Delinquency Report:

Note: MBA’s quarterly report relies on the headline delinquency measures used by each capital source. Each capital source’s measure is different. The different measures can give a good indication of delinquency trends within a source but should not be used to compare any one capital source to another.

- Commercial and multifamily mortgage delinquency rates varied by capital source in the fourth quarter of 2020.

- Headline delinquency rates (30-plus days delinquent or in foreclosure or REO) for the commercial mortgage-backed securities market decreased to 7.5%, which is down from 8.6% in the third quarter.

- The 60-plus day delinquency rate for life insurance company loans declined from 0.17% to 0.16%.

- Fannie Mae reported a multifamily 60-plus day delinquency rate of 0.98%, and Freddie Mac reported a rate of 0.16%.

- Note: Fannie Mae reports loans that are receiving payment forbearance as delinquent, while Freddie Mac excludes those loans.

- The 90-plus day delinquency rate for commercial and multifamily loans held on bank balance sheets rose from 0.72% to 0.83%.

- MBA’s analysis incorporates the measures used by each individual investor group to track the performance of their loans. Because each investor group tracks delinquencies in its own way, delinquency rates are not comparable from one group to another.

To view the report, click here. Differences between the delinquency measures are detailed in Appendix A.