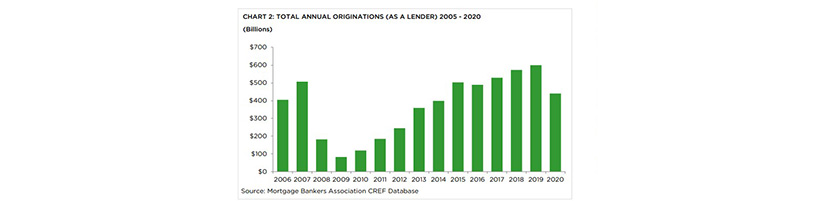

MBA: 2020 Commercial, Multifamily Mortgage Bankers Originations Fall to $441.5 Billion

Commercial and multifamily mortgage bankers closed $441.5 billion in loans in 2020, the Mortgage Bankers Association’s 2020 Commercial Real Estate/Multifamily Finance Annual Origination Volume Summation reported, nearly 26 percent lower than the record $601 billion reported in 2019.

“Commercial and multifamily borrowing and lending in 2020 fell by a quarter from 2019’s record year, as the COVID-19 pandemic disrupted the economy and created increased uncertainty,” said MBA Vice President of Commercial Real Estate Research Jamie Woodwell. “The property types most impacted by the pandemic–lodging and retail–saw the largest declines in originations, while those in which investors and lenders had the greatest confidence, particularly multifamily, held up better.”

Woodwell noted the source of capital also mattered, with government-backed loans from the Fannie Mae, Freddie Mac and FHA hitting record highs in volume.

Multifamily properties saw the highest volume of mortgage bankers’ origination volume last year at $272.0 billion, followed by office buildings, industrial properties, retail, health care and hotel/motel. First liens accounted for 98 percent of the total dollar volume closed.

The government-sponsored enterprises (Fannie Mae and Freddie Mac) led capital sources for originated loans in 2020, $164.1 billion of the total. Depositories saw the second-highest volume at $109.3 billion, followed by life insurance companies and pension funds, commercial mortgage-backed securities issuers and FHA/Ginnie Mae.

Visit the MBA online store for a copy of the report.