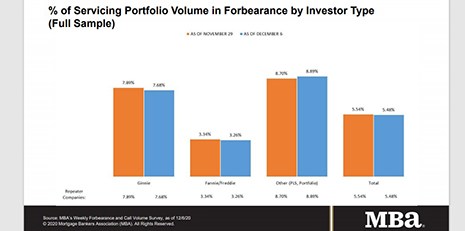

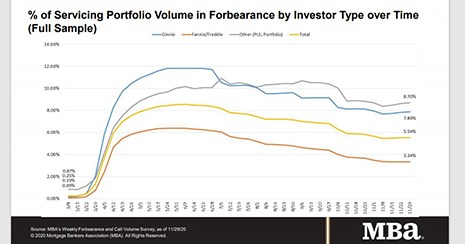

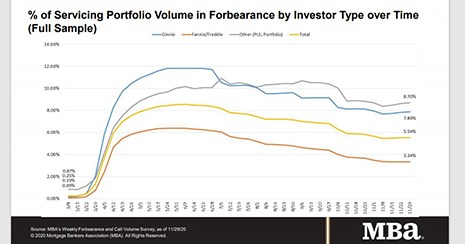

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.48% of servicers’ portfolio volume as of December 6 from 5.54% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

Tag: Independent Mortgage Banks

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.

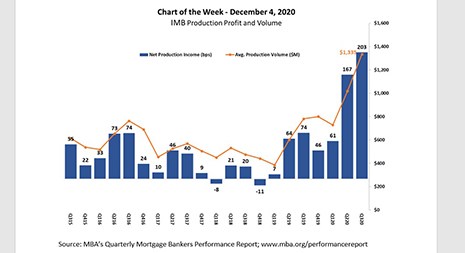

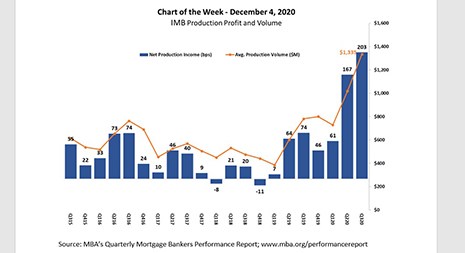

MBA Chart of the Week: IMB Production Profit and Volume

MBA released its latest Quarterly Performance Report for the third quarter last week. Independent mortgage banks and mortgage subsidiaries of chartered banks reported study-high average pre-tax production profits of 203 basis points ($5,535 on each loan originated) in the third quarter, up from 167 basis points ($4,548 per loan) in the second quarter.

MBA Chart of the Week: IMB Production Profit and Volume

MBA released its latest Quarterly Performance Report for the third quarter last week. Independent mortgage banks and mortgage subsidiaries of chartered banks reported study-high average pre-tax production profits of 203 basis points ($5,535 on each loan originated) in the third quarter, up from 167 basis points ($4,548 per loan) in the second quarter.

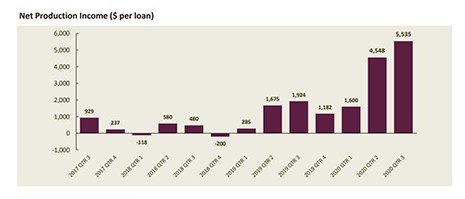

MBA: 3Q Mortgage Production Volume Spurs Strong IMB Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $5,535 on each loan they originated in the third quarter, up from $4,548 per loan in the second quarter, the Mortgage Bankers Association reported this morning in its Quarterly Mortgage Bankers Performance Report.

MBA: 3Q Mortgage Production Volume Spurs Strong IMB Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $5,535 on each loan they originated in the third quarter, up from $4,548 per loan in the second quarter, the Mortgage Bankers Association reported this morning in its Quarterly Mortgage Bankers Performance Report.

MBA: 3Q Mortgage Production Volume Spurs Strong IMB Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $5,535 on each loan they originated in the third quarter, up from $4,548 per loan in the second quarter, the Mortgage Bankers Association reported this morning in its Quarterly Mortgage Bankers Performance Report.

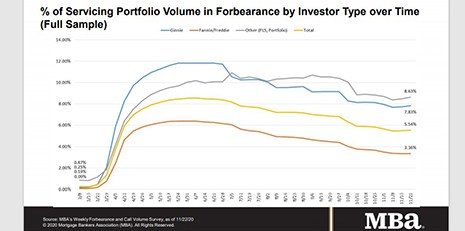

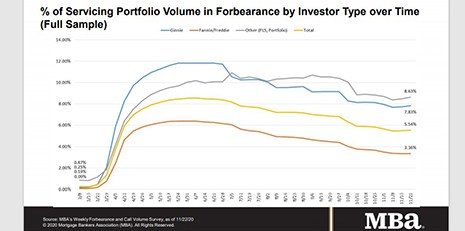

MBA: Share of Mortgage Loans in Forbearance Increases to 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.54% of servicers’ portfolio volume as of November 22, 2020 from 5.48% the prior week. MBA estimates 2.8 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.54% of servicers’ portfolio volume as of November 22, 2020 from 5.48% the prior week. MBA estimates 2.8 million homeowners are in forbearance plans.