MBA: 3Q Mortgage Production Volume Spurs Strong IMB Profits

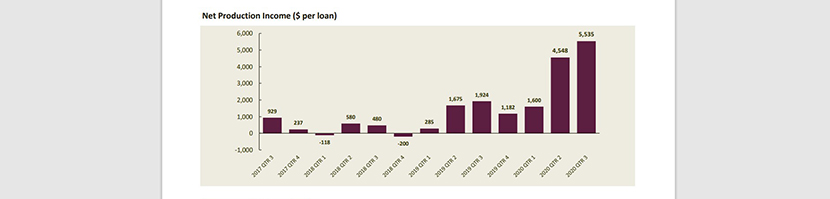

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $5,535 on each loan they originated in the third quarter, up from $4,548 per loan in the second quarter, the Mortgage Bankers Association reported this morning in its Quarterly Mortgage Bankers Performance Report.

“With the surge in mortgage production volume in the third quarter, net production profits among independent mortgage bankers increased, surpassing 200 basis points for the first time since the inception of MBA’s report in 2008,” said MBA Vice President of Industry Analysis Marina Walsh, CMB. “Soaring production revenues – led by strong secondary marketing gains – drove these results and more than offset an increase in production expenses.”

Walsh noted production expenses usually drop with increased volume, as fixed costs are spread over more loans. “But in the third quarter, costs rose despite the volume increase,” she said. “One major reason for this increase was escalating personnel costs, including signing bonuses, incentives, overtime and commissions that were pushed higher with the need and competition for workforce talent.”

Combining both production and servicing operations, MBA reported a study-high 99 percent of firms posted overall profitability for the third quarter, despite continued net servicing losses resulting from mortgage servicing rights impairment and amortization.

Key findings of the MBA third quarter Quarterly Mortgage Bankers Performance Report:

- Average pre-tax production profit rose to 203 basis points in the third quarter, up from an average net production profit of 167 bps in the second quarter. The average quarterly pre-tax production profit, from third quarter 2008 to the most recent quarter, is 52 basis points.

- Average production volume grew to $1.34 billion per company in the third quarter, up from $1.02 billion per company in the second quarter. Volume by count per company averaged 4,732 loans in the third quarter, up from 3,631 loans last quarter.

- Total production revenue (fee income, net secondary marking income and warehouse spread) increased to 475 bps in the third quarter, up from 429 bps in the second quarter. On a per-loan basis, production revenues increased to $12,987 per loan in the third quarter, up from $11,686 per loan in the second quarter.

- Net secondary marketing income increased to 394 bps in the third quarter, up from 341 bps in the second quarter. On a per-loan basis, net secondary marketing income increased to $10,833 per loan in the third quarter from $9,355 per loan in the second quarter.

- Purchase share of total originations, by dollar volume, increased to 46 percent in the third quarter from 39 percent in the second quarter. For the mortgage industry as a whole, MBA estimates purchase share at 43 percent in the third quarter.

- Average loan balance for first mortgages increased to a new study high of $282,659 in the third quarter, up from $282,309 in the second quarter.

- Average pull-through rate (loan closings to applications) rose to 72 percent in the third quarter, up from 71 percent in the second quarter.

- Total loan production expenses – commissions, compensation, occupancy, equipment and other production expenses and corporate allocations – increased to $7,452 per loan in the third quarter, up from $7,138 per loan in the second quarter. From third quarter 2008 to last quarter, loan production expenses have averaged $6,566 per loan.

- Personnel expenses averaged $5,124 per loan in the third quarter, up from $4,992 per loan in the second quarter.

- Productivity increased to 4.3 loans originated per production employee per month in the third quarter, up from 3.5 loans per production employee per month in the second quarter. Production employees includes sales, fulfillment and production support functions.

- Servicing net financial income for the third quarter (without annualizing) was at a loss of $30 per loan, compared to a loss of $68 per loan in the second quarter. Servicing operating income, which excludes MSR amortization, gains/loss in the valuation of servicing rights net of hedging gains/losses and gains/losses on the bulk sale of MSRs, rose to $26 per loan in the third quarter, up from $23 per loan in the second quarter.

- Including all business lines (both production and servicing), 99 percent of the firms in the study posted pre-tax net financial profits in the third quarter, up from 96 percent in the second quarter.

The MBA Mortgage Bankers Performance Report series offers a variety of performance measures on the mortgage banking industry and is intended as a financial and operational benchmark for independent mortgage companies, bank subsidiaries and other non-depository institutions. Eighty-four percent of the 347 companies that reported production data for the third quarter were independent mortgage companies; the remaining 16 percent were subsidiaries and other non-depository institutions.

MBA produces five Mortgage Bankers Performance Report publications per year: four quarterly reports and one annual report. To purchase or subscribe to the publications, call (202) 557-2879. Reports can also be purchased on MBA’s website by visiting www.mba.org/PerformanceReport.