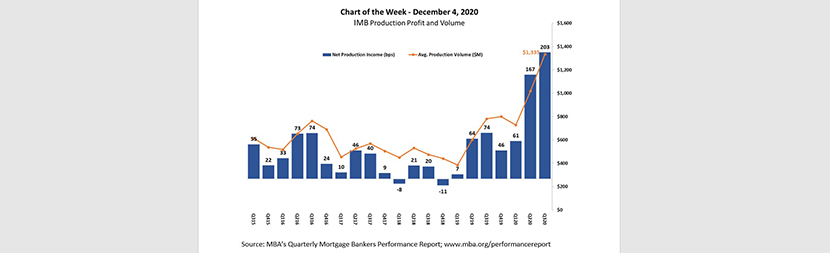

MBA Chart of the Week: IMB Production Profit and Volume

Source: MBA’s Quarterly Mortgage Bankers Performance Report www.mba.org/performancereport

MBA released its latest Quarterly Performance Report for the third quarter last week. Independent mortgage banks and mortgage subsidiaries of chartered banks reported study-high average pre-tax production profits of 203 basis points ($5,535 on each loan originated) in the third quarter, up from 167 basis points ($4,548 per loan) in the second quarter.

Total production revenue (fee income, net secondary marking income and warehouse spread) increased to a study-high of 475 bps ($12,987 per loan) in the third quarter from 429 bps ($11,686 per loan) in the second quarter. This increase in revenue was primarily driven by net secondary marketing gains, which increased to 395 bps in the third quarter from 341 bps in the second quarter.

Despite record volume averaging $1.34 billion per company (4,732 loans per company), production expenses per loan rose in the third quarter. To meet mortgage demand, companies ramped up their hiring and provided increased incentives for existing employees. Corresponding production costs rose to $7,452 per loan from $7,138 per loan in the second quarter.

Including all business lines (both production and servicing), 99 percent of the firms in the study posted pre-tax net financial profits in the third quarter, up from 96 percent in the second quarter.

— Jenny Masoud (jmasoud@mba.org); Marina Walsh (mwalsh@mba.org)