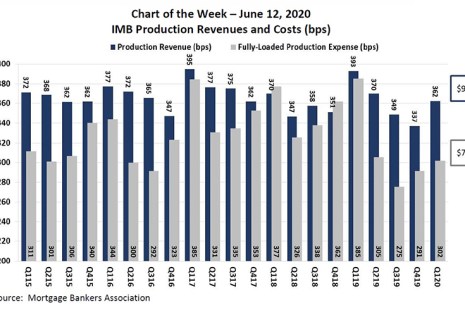

MBA last week released its Quarterly Performance Report for the first quarter. The total sample of 336 independent mortgage banks and mortgage subsidiaries of chartered banks earned an average pre-tax production profit of 61 basis points (or $1,600) on each loan they originated – a solid showing particularly for a first quarter.

Tag: Independent Mortgage Banks

MBA Chart of the Week: IMB Production Revenues & Costs

MBA last week released its Quarterly Performance Report for the first quarter. The total sample of 336 independent mortgage banks and mortgage subsidiaries of chartered banks earned an average pre-tax production profit of 61 basis points (or $1,600) on each loan they originated – a solid showing particularly for a first quarter.

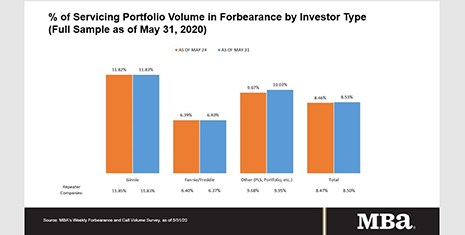

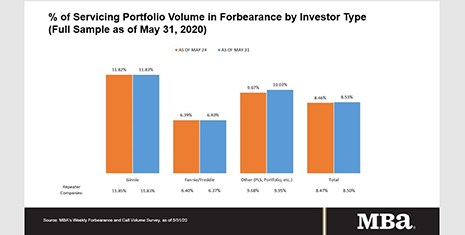

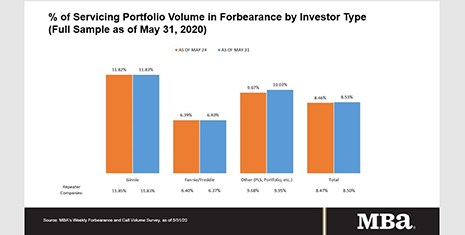

MBA Survey: Share of Mortgage Loans in Forbearance Slows to 8.53%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.53% of mortgage servicers’ portfolio volume as of May 31, compared to 8.46% the prior week. MBA now estimates nearly 4.3 million homeowners are in forbearance plans.

MBA Survey: Share of Mortgage Loans in Forbearance Slows to 8.53%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.53% of mortgage servicers’ portfolio volume as of May 31, compared to 8.46% the prior week. MBA now estimates nearly 4.3 million homeowners are in forbearance plans.

MBA Survey: Share of Mortgage Loans in Forbearance Increases to 8.53%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.53% of mortgage servicers’ portfolio volume as of May 31, compared to 8.46% the prior week. MBA now estimates nearly 4.3 million homeowners are in forbearance plans.

MBA: IMBs Report Strong First Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $1,600 on each loan they originated in the first quarter, up from $1,182 per loan in the fourth quarter, according to the Mortgage Bankers Association’s newly released Quarterly Mortgage Bankers Performance Report.

MBA: IMBs Report Strong First Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $1,600 on each loan they originated in the first quarter, up from $1,182 per loan in the fourth quarter, according to the Mortgage Bankers Association’s newly released Quarterly Mortgage Bankers Performance Report.

Tom Lamalfa: May 2020 Survey of Secondary Market Executives

What follows are findings from a survey of senior mortgage executives I conducted in the first half of May. Due to cancellation of MBA’s National Secondary Market Conference, this survey was completed over the phone rather than face to face, as has been the case in the 23 preceding surveys done since 2008. Normally the surveys are conducted at the secondary conference as well as at the MBA Annual Convention every October.

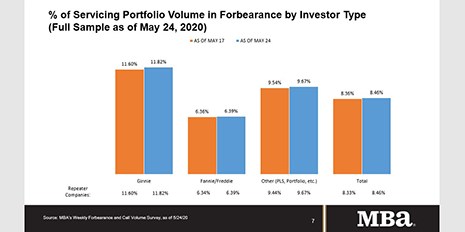

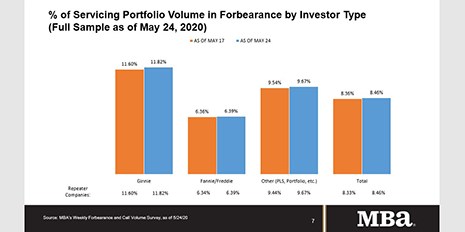

MBA: Share of Mortgage Loans in Forbearance Increases to 8.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.46% of servicers’ portfolio volume from 8.36% the prior week as of May 24. MBA estimates 4.2 million homeowners are now in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 8.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.46% of servicers’ portfolio volume from 8.36% the prior week as of May 24. MBA estimates 4.2 million homeowners are now in forbearance plans.