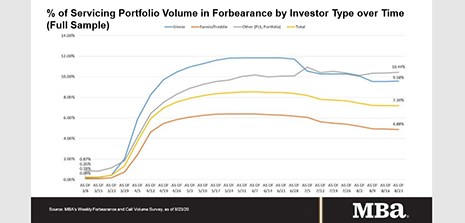

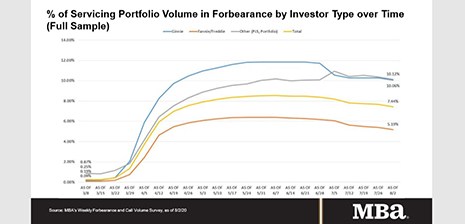

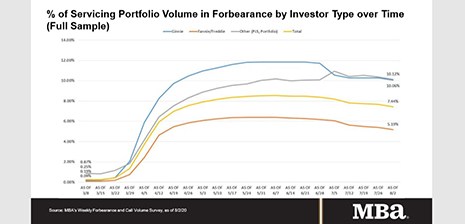

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the percentage of loans in forbearance stayed flat for the second straight week, holding at 7.20% as of Aug. 23.

Tag: Independent Mortgage Banks

MBA: Share of Mortgage Loans in Forbearance Flat

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by just 1 basis point, from 7.20% of servicers’ portfolio volume as of Aug. 16 from the prior week. MBA estimates 3.6 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Flat

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by just 1 basis point, from 7.20% of servicers’ portfolio volume as of Aug. 16 from the prior week. MBA estimates 3.6 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Flat

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by just 1 basis point, from 7.20% of servicers’ portfolio volume as of Aug. 16 from the prior week. MBA estimates 3.6 million homeowners are in forbearance plans.

MBA: Loans in Forbearance Fall 9th Straight Week

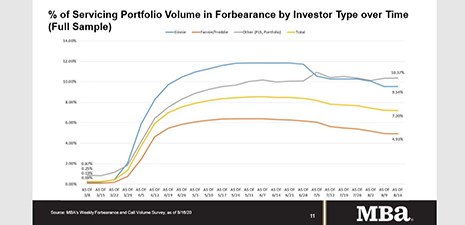

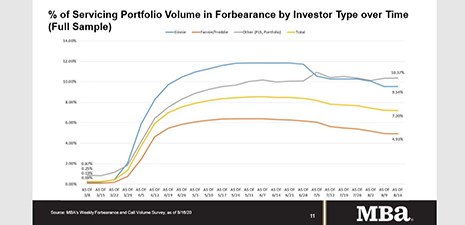

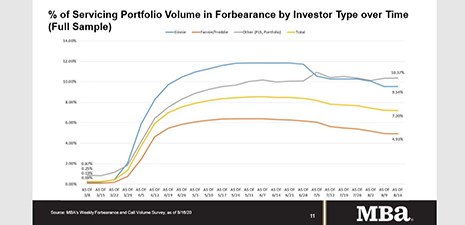

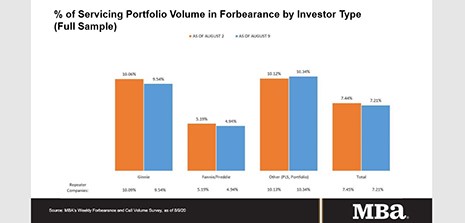

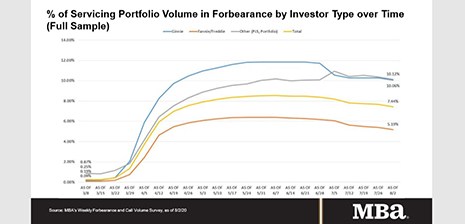

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 23 basis points to 7.21% of servicers’ portfolio volume the week of Aug. 9 from 7.44% the previous week. MBA estimates 3.6 million homeowners are in forbearance plans.

MBA: Loans in Forbearance Fall 9th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 23 basis points to 7.21% of servicers’ portfolio volume the week of Aug. 9 from 7.44% the previous week. MBA estimates 3.6 million homeowners are in forbearance plans.

MBA: Loans in Forbearance Fall 9th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 23 basis points to 7.21% of servicers’ portfolio volume the week of Aug. 9 from 7.44% the previous week. MBA estimates 3.6 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.