MBA: Share of Mortgage Loans in Forbearance Flat at 7.20%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the percentage of loans in forbearance stayed flat for the second straight week, holding at 7.20% as of Aug. 23.

MBA estimated 3.6 million homeowners are in forbearance plans.

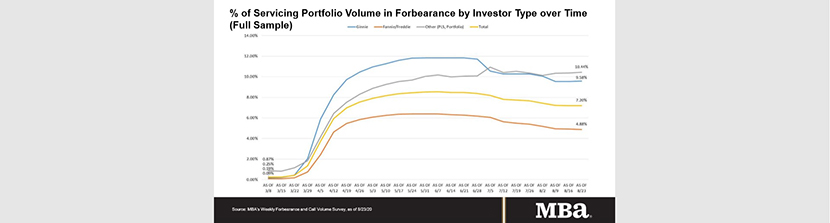

The share of Fannie Mae and Freddie Mac loans in forbearance dropped for the 12th week in a row to 4.88% – a 5-basis-point improvement. Ginnie Mae loans in forbearance increased by 4 basis points to 9.58%, while the forbearance share for portfolio loans and private-label securities increased by 7 basis points to 10.44%. The percentage of loans in forbearance for depository servicers increased to 7.49%, and the percentage of loans in forbearance for independent mortgage bank servicers decreased to 7.41%.

“The share of loans in forbearance was unchanged, as the decline in the share of GSE loans was offset by increases for Ginnie Mae, and portfolio and PLS loans,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “The pace of new forbearance requests has been relatively flat across investor types, but for those with GSE loans, the rate of exits from forbearance regularly exceeds the rate of new requests. The exception in these trends are borrowers with Ginnie Mae loans. The loss of enhanced unemployment insurance benefits, coupled with a consistently high rate of layoffs and uncertainty about the job market, are having a disproportionate impact on FHA and VA borrowers.”

Key findings of the MBA’s Forbearance and Call Volume Survey – August 17 – August 23

- Total loans in forbearance remained unchanged relative to the prior week at 7.20%.

- By investor type, the share of Ginnie Mae loans in forbearance increased relative to the prior week: from 9.54% to 9.58%.

- The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior week: from 4.93% to 4.88%.

- The share of other loans (e.g., portfolio and PLS loans) in forbearance increased relative to the prior week: from 10.37% to 10.44%.

- By stage, 36.71% of total loans in forbearance are in the initial forbearance plan stage, while 62.43% are in a forbearance extension. The remaining 0.86% are forbearance re-entries.

- Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained unchanged relative to the prior week at 0.10%.

- Weekly servicer call center volume:

- As a percent of servicing portfolio volume (#), calls decreased from 8.7% to 7.2%.

- Average speed to answer decreased from 2.8 minutes to 2.2 minutes.

- Abandonment rates decreased from 5.7% to 4.9%.

- Average call length increased from 7.2 minutes to 7.7 minutes.

- Loans in forbearance as a share of servicing portfolio volume (#) as of August 23:

- Total: 7.20% (previous week: 7.20%)

- IMBs: 7.41% (previous week: 7.43%)

- Depositories: 7.49% (previous week: 7.48%)

The MBA Forbearance and Call Volume Survey represents 75% of the first-mortgage servicing market (37.3 million loans).